The goal of this content is to help mortgage professionals ensure they are working as efficiently as possible throughout the entire mortgage process, end-to-end.

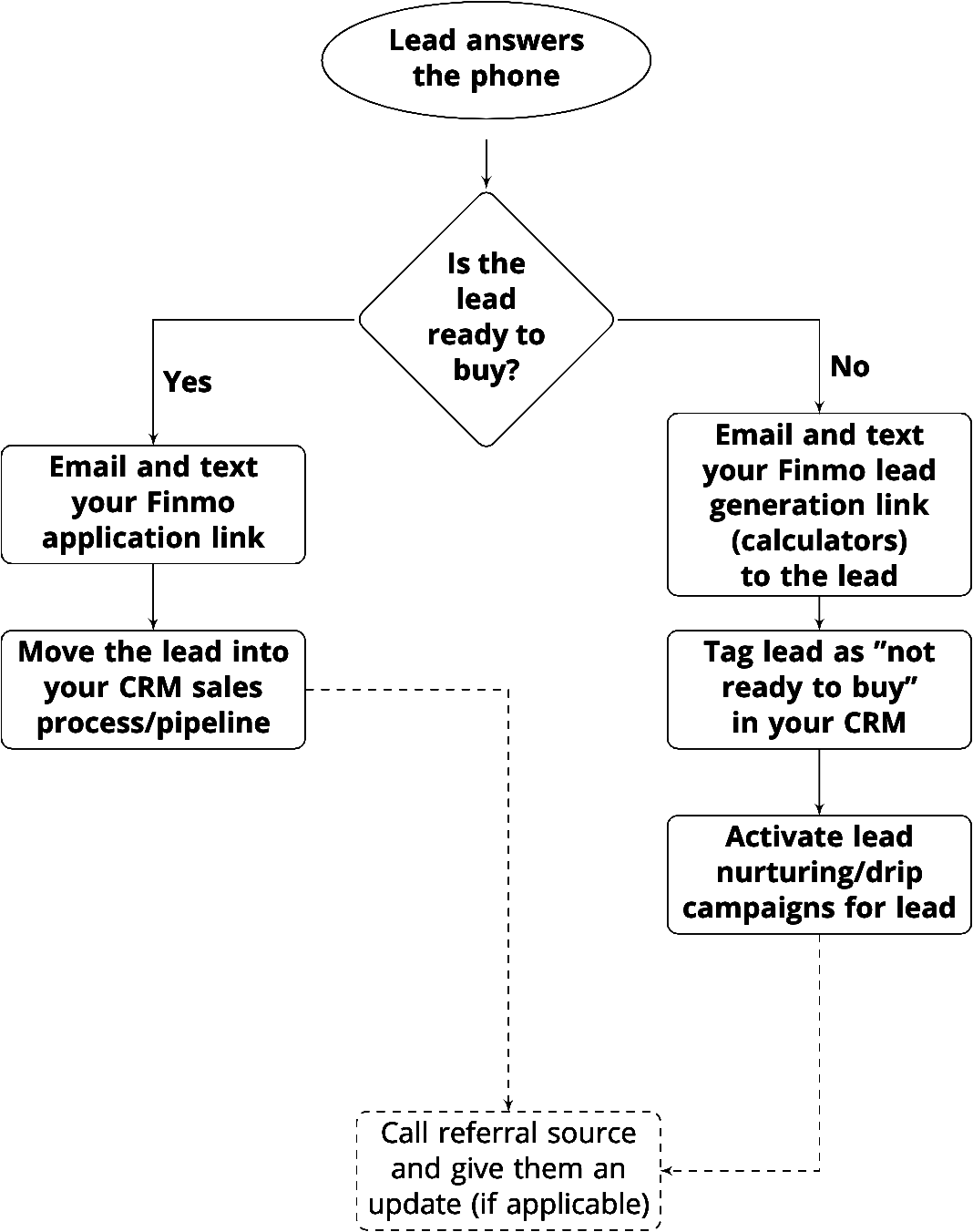

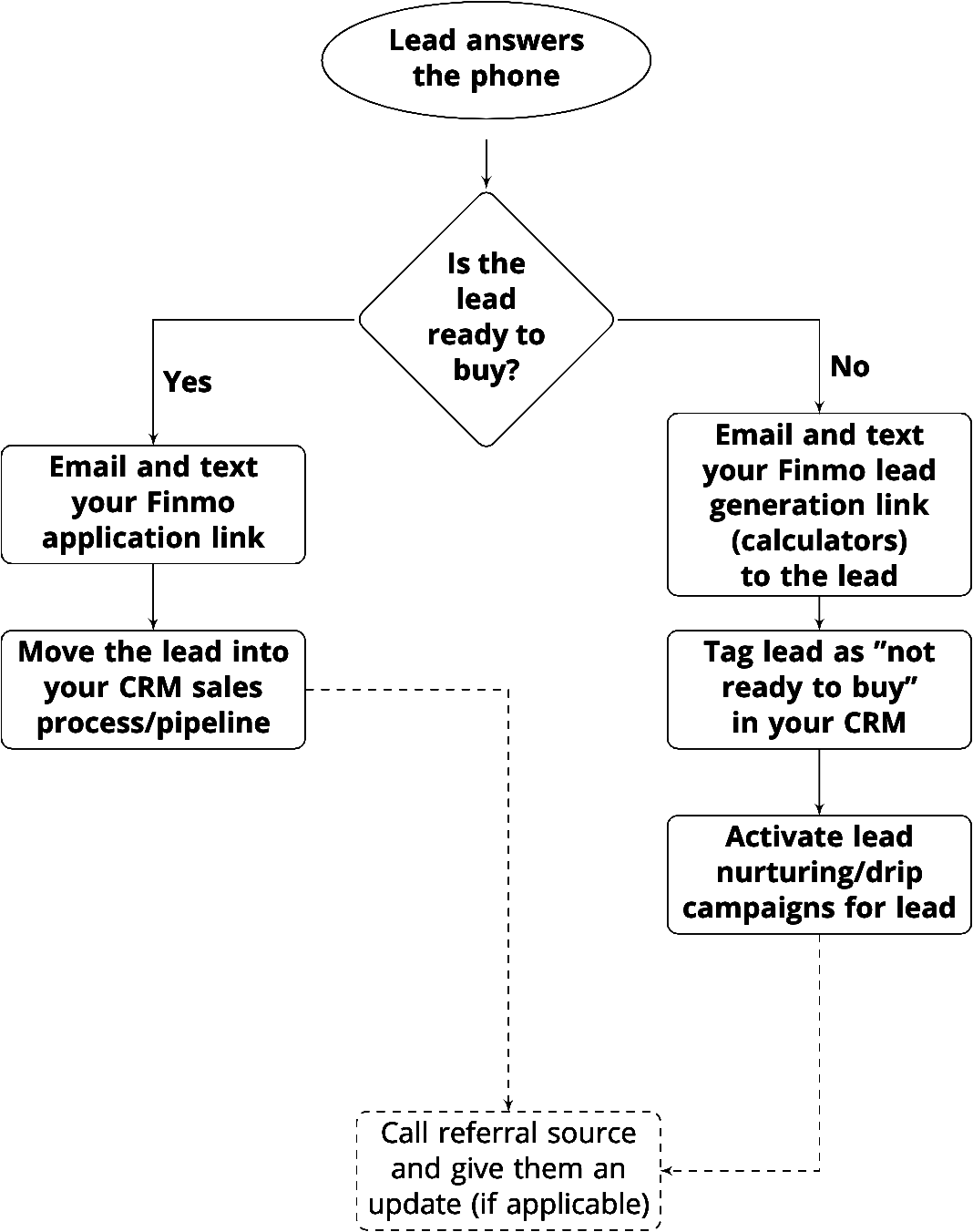

Flowcharts

The following flowcharts represent a high-level overview of the mortgage origination process.

A new lead comes in

Lead answers the phone

Sales process

In detail

Enter the lead into your CRM

Always enter any lead’s information in your CRM (Customer Relationship Management software) as soon as it is referred to you. This is a great habit to develop. It ensures you do not accidentally forget to follow-up, which is just leaving money on the table.

Call the lead immediately

The best chance we have at closing our new lead is to introduce ourselves as quickly as possible! Various studies have shown that faster you reach out to your new lead, the better your chances are of closing them. The odds of a phone call resulting in contact with the new lead decrease by more than 10 times in the first hour.

Leave a voice mail, email and text message

Different people prefer different communication methods, so demonstrating right from the beginning that you’re readily available on the communication channel of their choice is a great idea.

Even better is to reference your communications sent on the other channels to increase your odds of getting in touch with the lead. For example, in the voicemail you can mention that you’ve also sent a text and an e-mail, and that they’re welcome to respond in whichever way they would prefer.

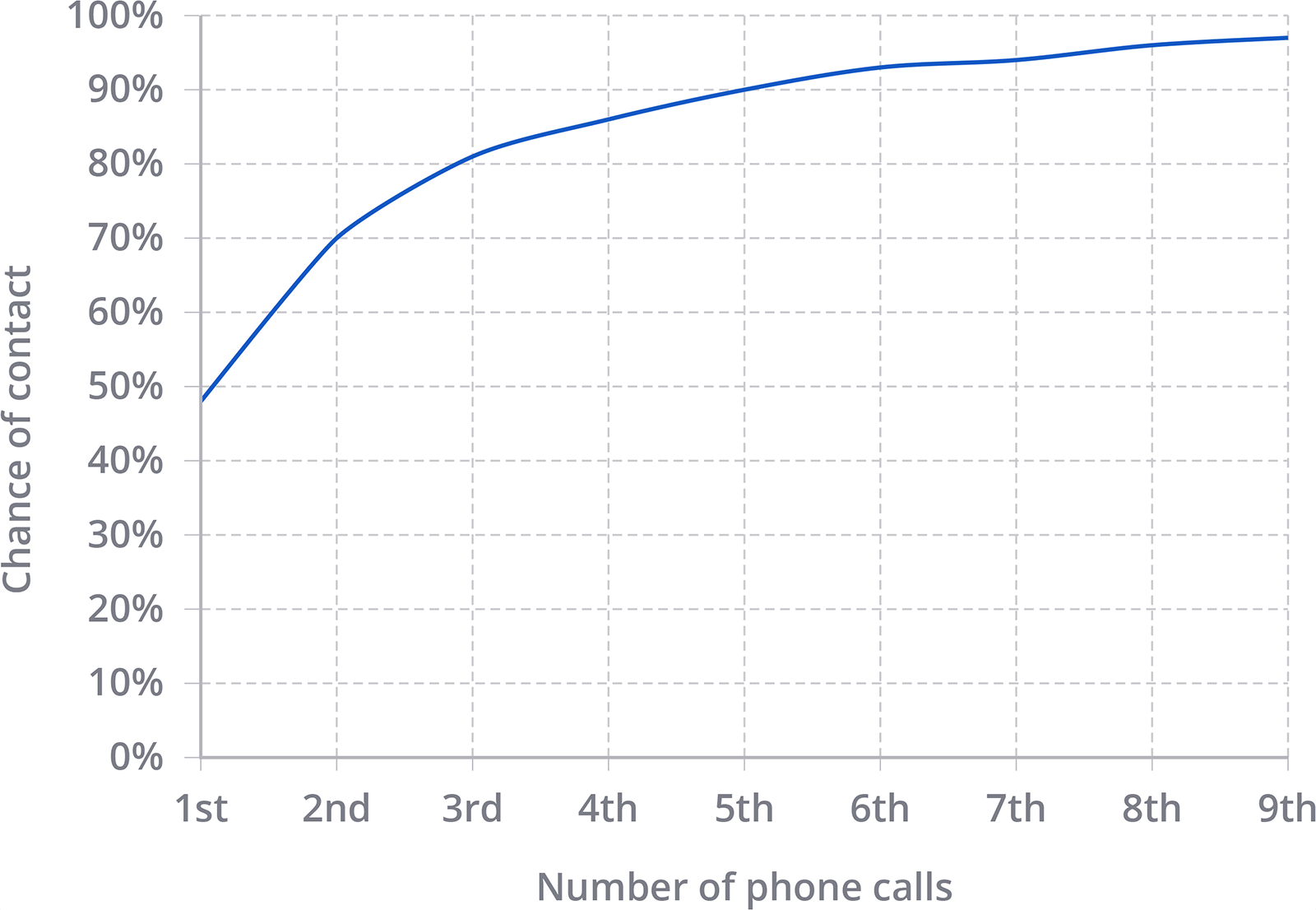

Call the lead six times

Calling a lead six times nearly doubles your chance of contacting them. Do not repeatedly call the lead. Allow for a reasonable amount of time to lapse between each phone call. Only send new voicemails, emails and text messages after appropriate time has passed (not necessarily after every single call).

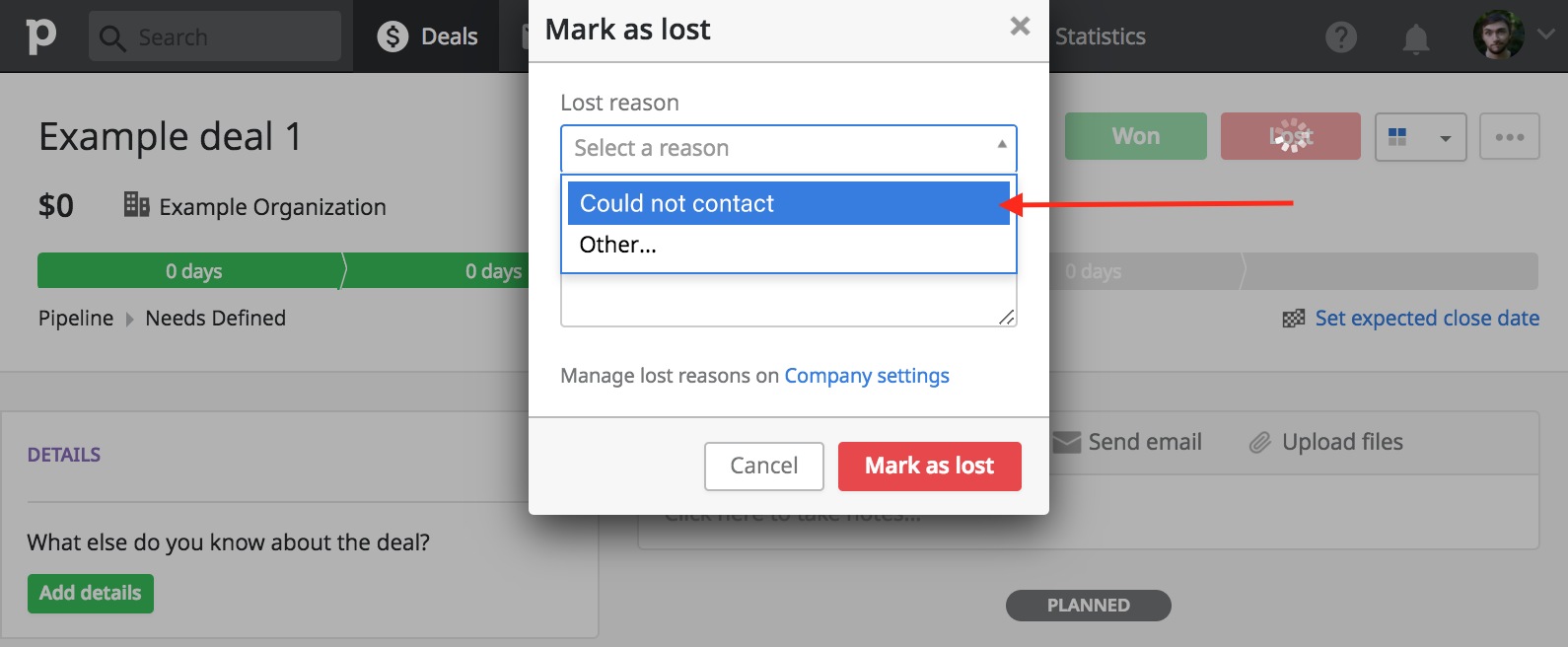

Tagging a lead as “could not contact” in your CRM

If you can not get in contact with your new lead, you need a way to indicate that in your CRM (Customer Relationship Management software).

For example, in PipeDrive, you would click the “lost” button on the lead’s “deal”. When you lose deals, you can select the reason from a pre-populated list of reasons that you can customize.

There are many ways to tag and segment leads in CRMs, and how you do it may vary depending on personal preference and which CRM software you are using.

If you would like a turn-key solution for this functionality, where all the software and workflow are already setup and documented for mortgage origination purposes, we recommend our partner BluMortgage.

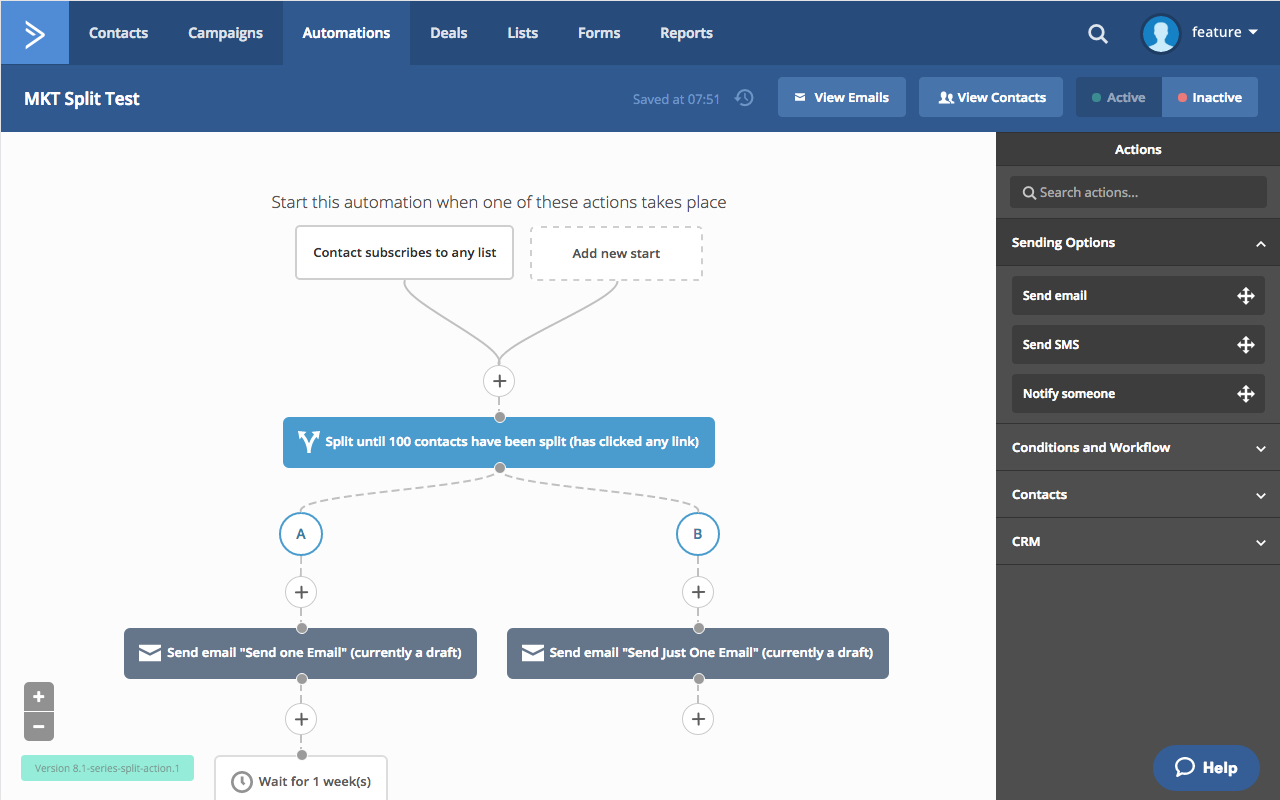

Long term lead nurturing and drip campaigns

We will always have leads that are not ready to enter the sales process. These could come in the form of either a lead we could not get in touch with, or a lead that we managed to contact but is not yet at the stage where they’re ready to transact.

These leads still represent potential revenue – just not immediately.

This is where lead nurturing (drip campaigns) come in. The goal of lead nurturing is to remain top of mind for when these borrowers finally are ready to buy a home, refinance, etc.

Lead nurturing is generally performed through “drip campaigns”. Drip campaigns are pre-written marketing campaigns that send the leads valuable content over time. When a lead is added to a drip campaign, they start at “day 0”, and are sent a series of pre-written emails at pre-planned intervals. With drip marketing campaigns, different leads receive different emails at different times. This is unlike traditional email marketing where an email is simultaneously sent to an entire segment of potential customers (new leads, old leads, past clients, etc).

Please keep in mind that you will often have multiple drip campaigns for different segments of your leads. For example, you do not want to send someone looking to do a refinance a bunch of drip info about how to purchase a new home.

A “first-time buyer” email drip campaign could look something like this:

| After: | Automatically send: |

|---|---|

| 3 days | Email: Video series on why rates are not everything (part 1) |

| 7 days | Email: Video series on why rates are not everything (part 2) |

| 14 days | Email: Video series on why rates are not everything (part 3) |

| 1 month | Email: Do you have any questions about mortgages? |

| 2 months | Email: What interest rates are currently doing |

| 3 months | Email: Checklist for new home purchases |

| 4 months | Email: Investment strategies involving home ownership |

| 5 months | Email: Current housing market conditions |

| 6 months | Email: Check-in and ask for referrals |

| 8 months | Email: Fixed versus variable rates |

| 1 year | Email: Check-in and ask for referrals |

| Etc. | Etc. |

Keep in mind that drip campaigns are in addition to, and not a replacement for, traditional email marketing – so try not to “drip” emails too frequently. You can also “drip” leads with other formats besides emails, such as ringless voicemails or text messages. If you do choose to pursue these marketing channels, please ensure you stay CASL compliant in order to avoid fines.

Is the lead ready to buy?

This section requires the context of viewing the flowcharts.

While we are on the phone with (or possibly emailing or texting) the lead, we need to determine through conversation what our next actions will be. The primary goal is to determine whether the lead is ready to enter the sales process or not.

Here are some considerations for categorizing whether the lead follows the “ready” (yes) flow, or the “not ready” (no) flow:

- A lead may want to buy a home (or refi, etc.), but we are categorizing them based on their ability to buy a home. If they can not buy a home even if they wanted to, they are categorized as not ready (no).

- If there is any actionable step we can take that may result in near-future revenue from this lead (that the lead is interested in pursuing), they can be categorized as ready (yes), which then initiates the sales process.

- If a lead could buy a home (or refi, etc.) but is not interested in buying immediately, they are categorized as not ready (no). The reason for this is because we want to put them on drip campaigns to convince them to use when they decide they are ready to buy, and that is our “not ready” (no) flow.

- If a lead is not ready to buy a home (or refi, etc.) be sure to get enough additional information to categorize them in the correct drip campaign. For example, make sure to note down details in your CRM such as if the lead is looking to purchase or refinance. It’s even better to go a step further and note down more detail such as if they are interested in constructing their new home. You may eventually have specific drip campaigns built out many different scenarios (the more relevant your drip campaigns are to what the lead is interested in, the better), so this information will become critical to proper categorization.

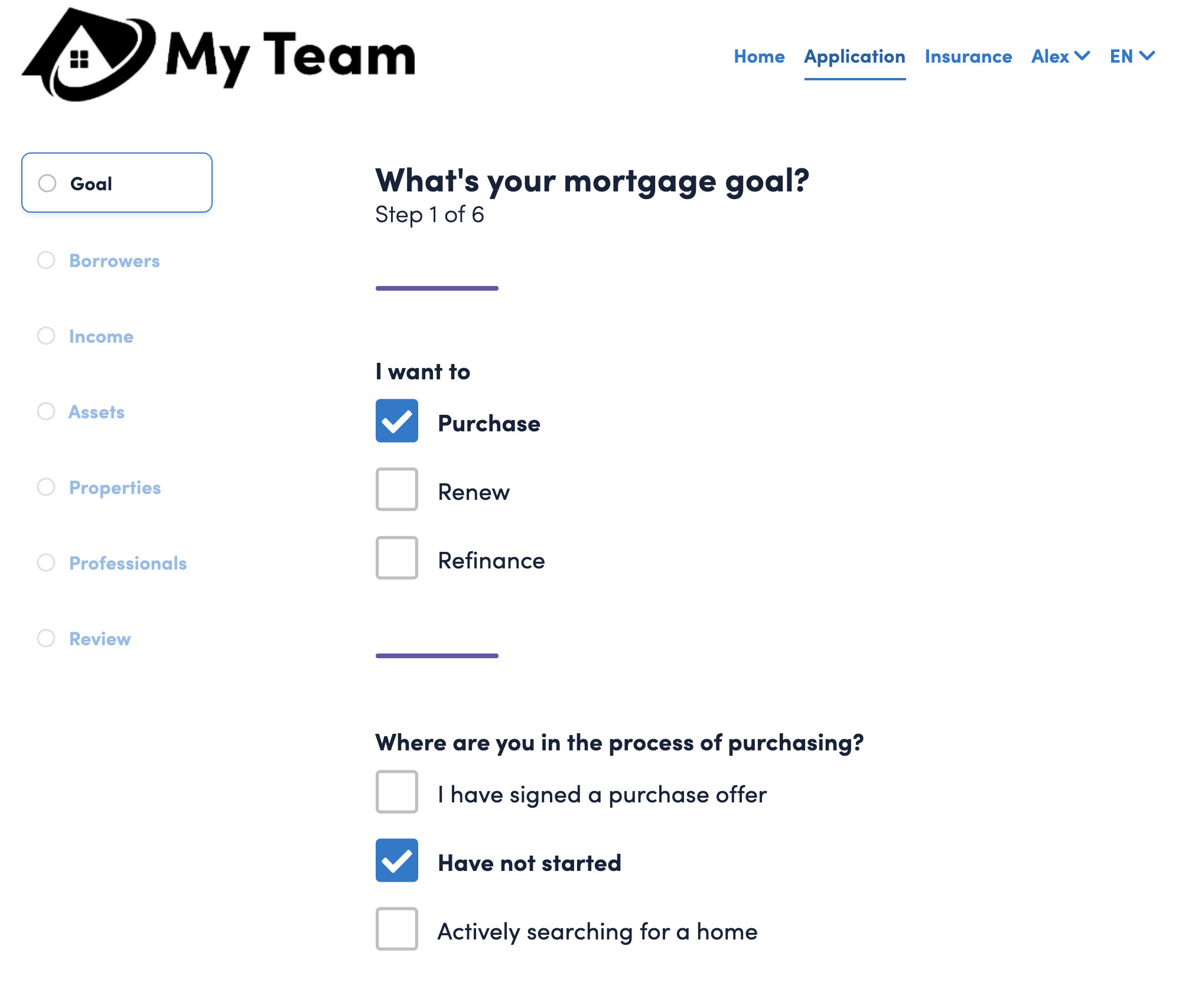

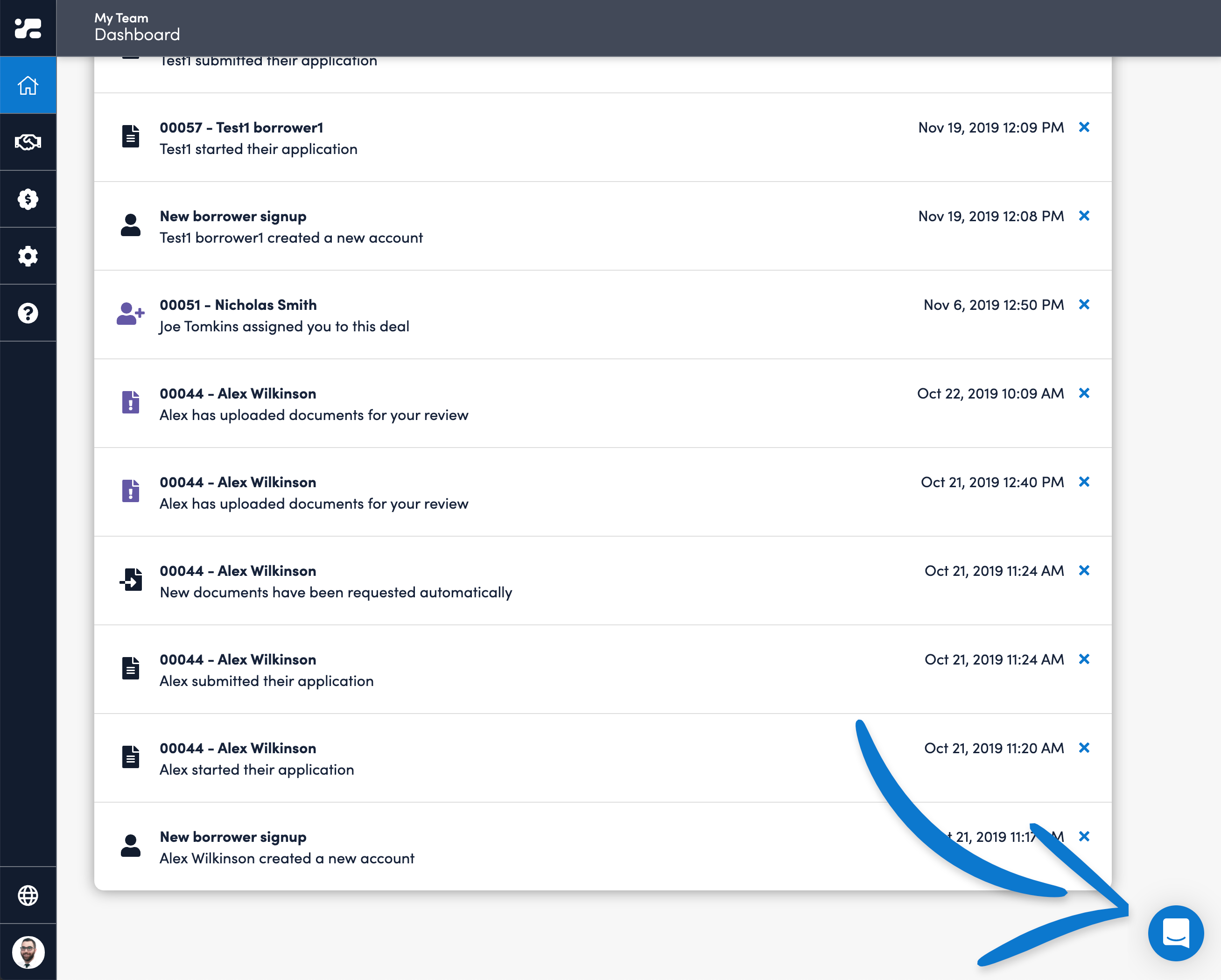

Ready to buy – send your Finmo application link

After you have determined that the lead is ready to buy, it’s time to gather their application and documents.

Finmo makes this exceptionally simple by combining both of these tasks into one step.

The simplest way to get started is to send your personal application link, which can be found in your personal account details in Finmo. This is a self-serve method where the lead creates a secure account, logs into their portal, and is automatically guided through filling out the application and uploading documentation by the system.

For power users, Finmo has a variety of types of application links that allow it to fit virtually all mortgage business requirements:

- Personal application link

- Your personal application link will intake mortgage applications (and documents) and assign the deal directly to you.

- Team application link

- Your team application link will intake mortgage applications (and documents) and assign the deal to specific team members. You can customize which team members your team link will assign deals to in your team settings.

- Referral application link

- A referral application link is the most flexible. It can assign deals to any team member, and can also include a specific referral source. This helps track from which sources your deals are coming from, which is very useful for analytics and reporting. For example, you could create separate referral application links for your website, Realtor partners, and various online advertising campaigns. Each referral application link can assign deals to specific team members.

If the lead would like to do the application “over the phone” you can create a new deal in Finmo and invite the lead to the application at any point. Usually you would invite the lead to create an account and log into their portal after you’ve gathered all the application data – when it’s time for them to upload their documentation. Finmo automatically requests the correct documentation based on what is entered into the application, so the lead can immediately begin uploading their documents. They can also review their application. It’s even possible to send control of the application back to the lead so they can revise any incorrect information themselves.

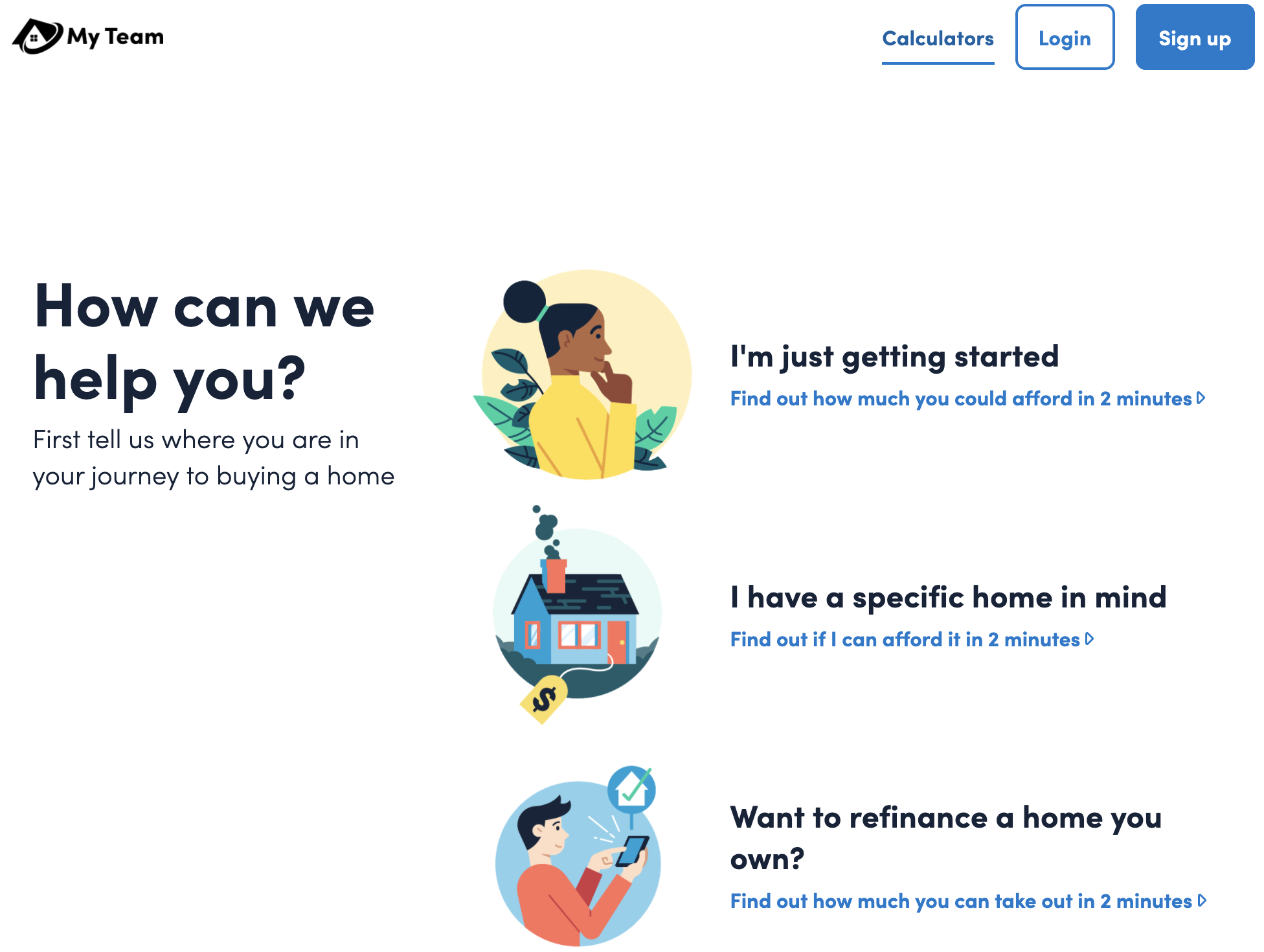

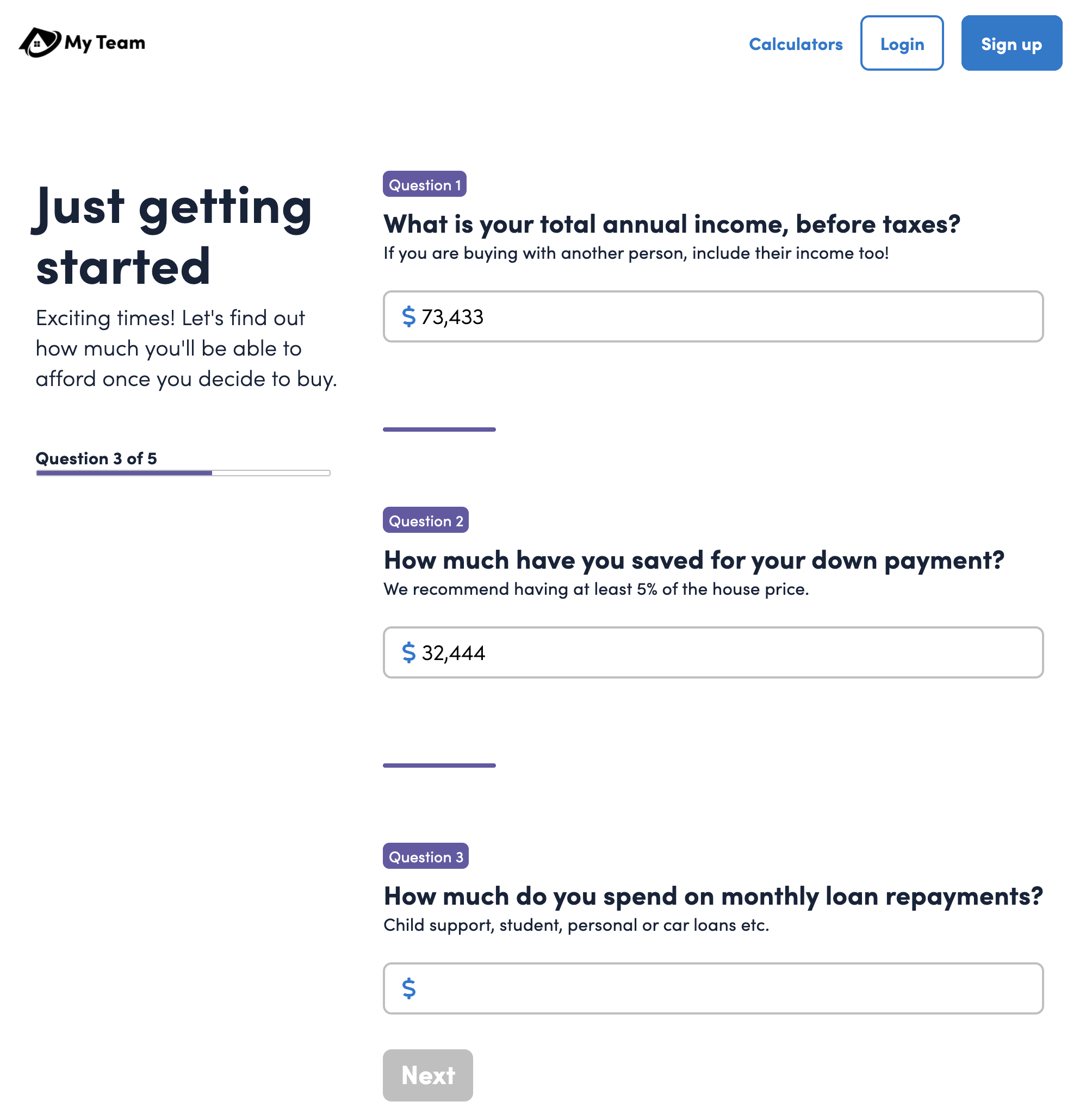

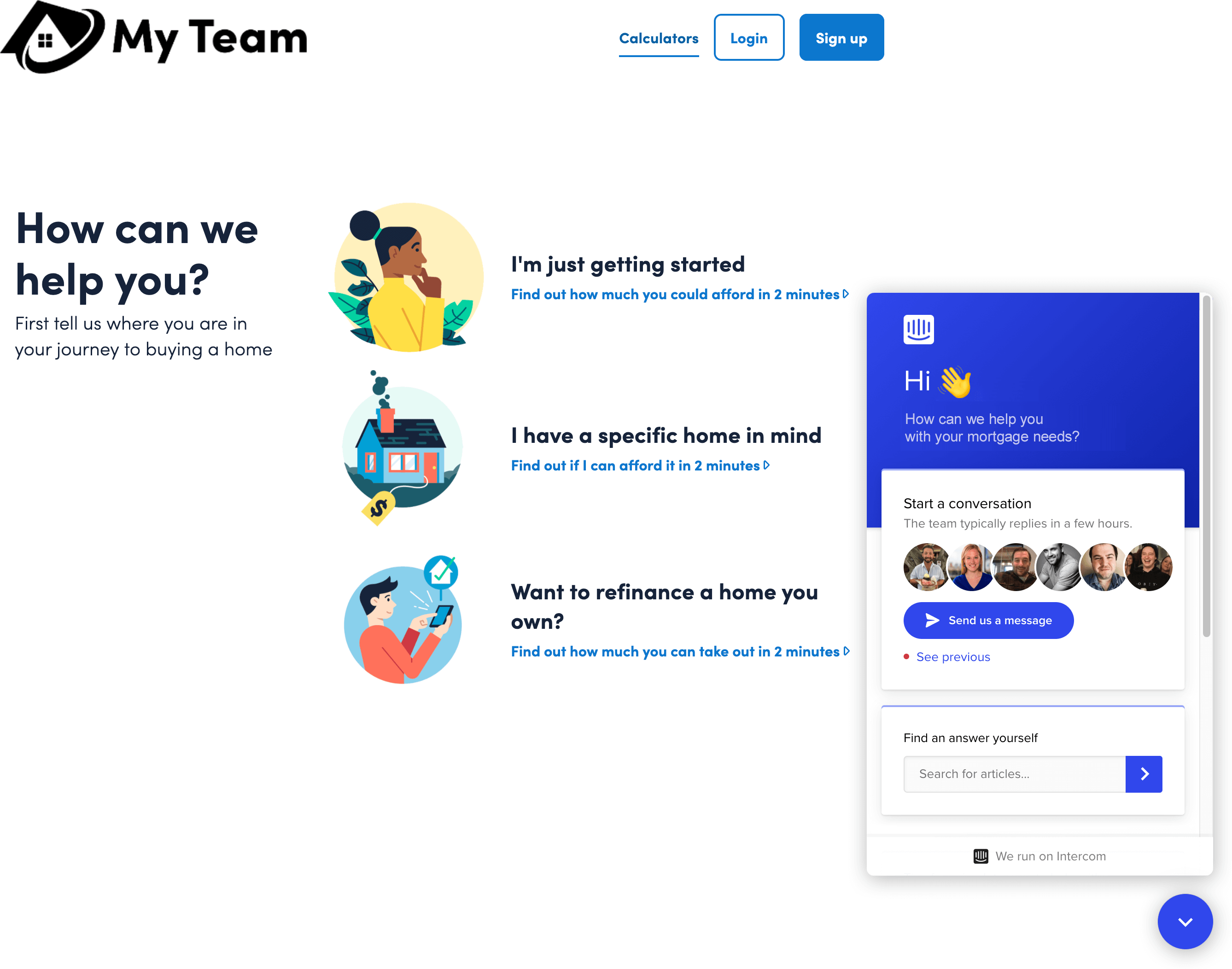

Not ready to buy – send your Finmo lead generation link

If the lead is not ready to buy, we can still provide them with value. An easy way to provide a lot of value is to send them a Finmo lead generation link.

Sending a lead generation link will provide the lead with calculators that will help them:

- Determine their maximum affordability.

- Determine if they can afford a specific property.

- Determine how much equity they have available in their home for a refinance.

Every time the borrower utilizes any of the calculators, they are asked if they would like to fill out a full mortgage application. This helps you stay top of mind for your leads, and increases the likelihood of getting their business.

A simple way to understand the difference between the lead generation links versus the application links is that the lead generation links first start with a “calculator funnel” that then leads into the application. The application links skip the calculator funnel and go directly into the application.

For power users, Finmo has a variety of lead generation link types that allow it to fit virtually all mortgage business requirements:

- Personal lead generation link

- Your personal lead generation link will intake mortgage applications (and documents) and assign the deal directly to you.

- Team lead generation link

- Your team lead generation link will intake mortgage applications (and documents) and assign the deal specific team members. You can customize which team members your team link will assign deals to in your team settings.

- Referral lead generation link

- A referral lead generation link is the most flexible. It can assign deals to any team member, and can also include a specific referral source. This helps track from which sources your deals are coming from, which is very useful for analytics and reporting. For example, you could create separate referral lead generation links for your website, Realtor partners, and various online advertising campaigns. Each referral lead generation link can assign deals to specific team members.

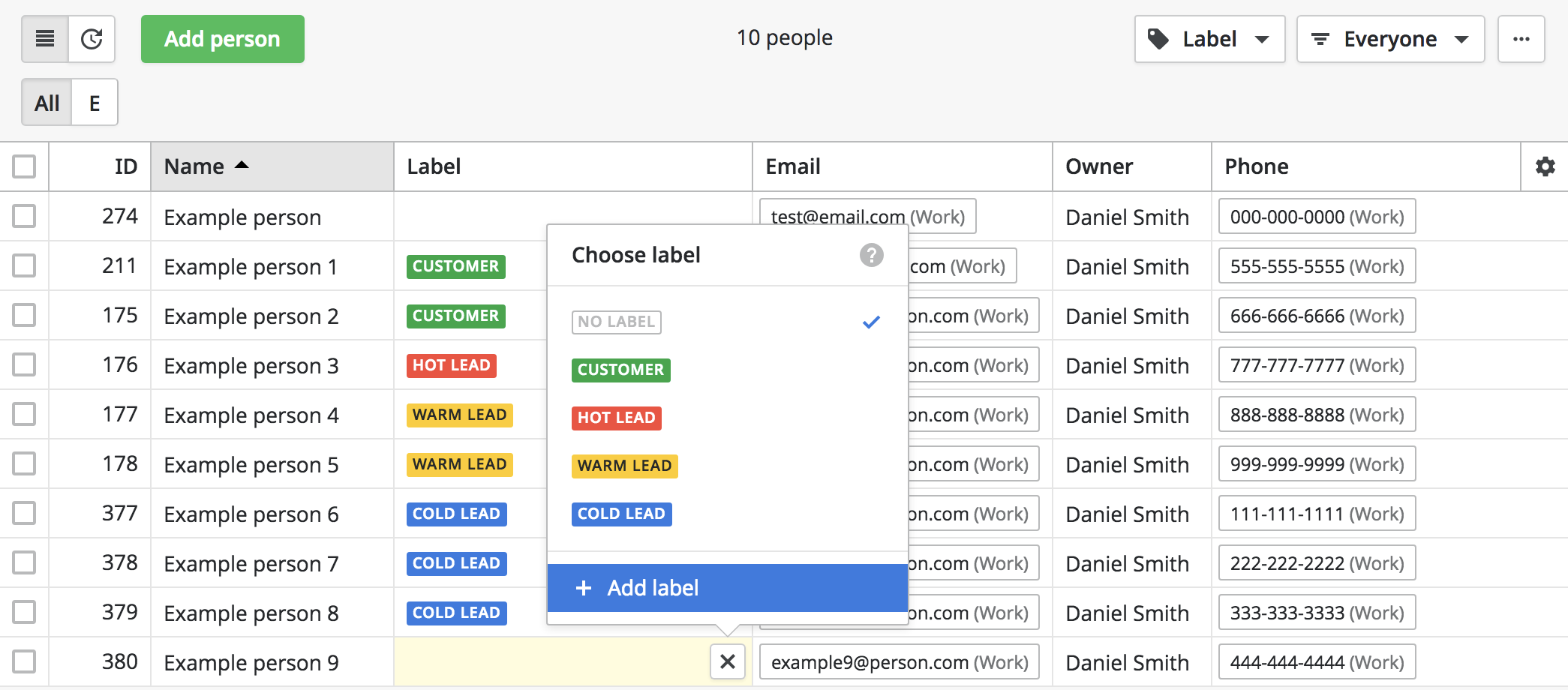

Tag lead as “not ready to buy” in your CRM

There are many ways to tag a lead as not ready to buy in a CRM. Many CRM’s allow “tagging”, or “labelling” which provides a flexible way to categorize your leads and deals.

Whatever your process ends up being for categorizing your leads – whether it’s tagging, labelling, or “losing” the deal (citing the reason as “not ready to buy”) – it’s important that you keep it consistent. Correctly categorizing leads avoids unnecessary clutter and reduces the chance for human error (multiple mortgage professionals contacting people twice about the same thing, etc).

Tagging your leads increases the accuracy of all of your reports, which in turn increases the accuracy of your sales forecasts. Having a CRM full of “clean” lead and deal data is a huge competitive advantage.

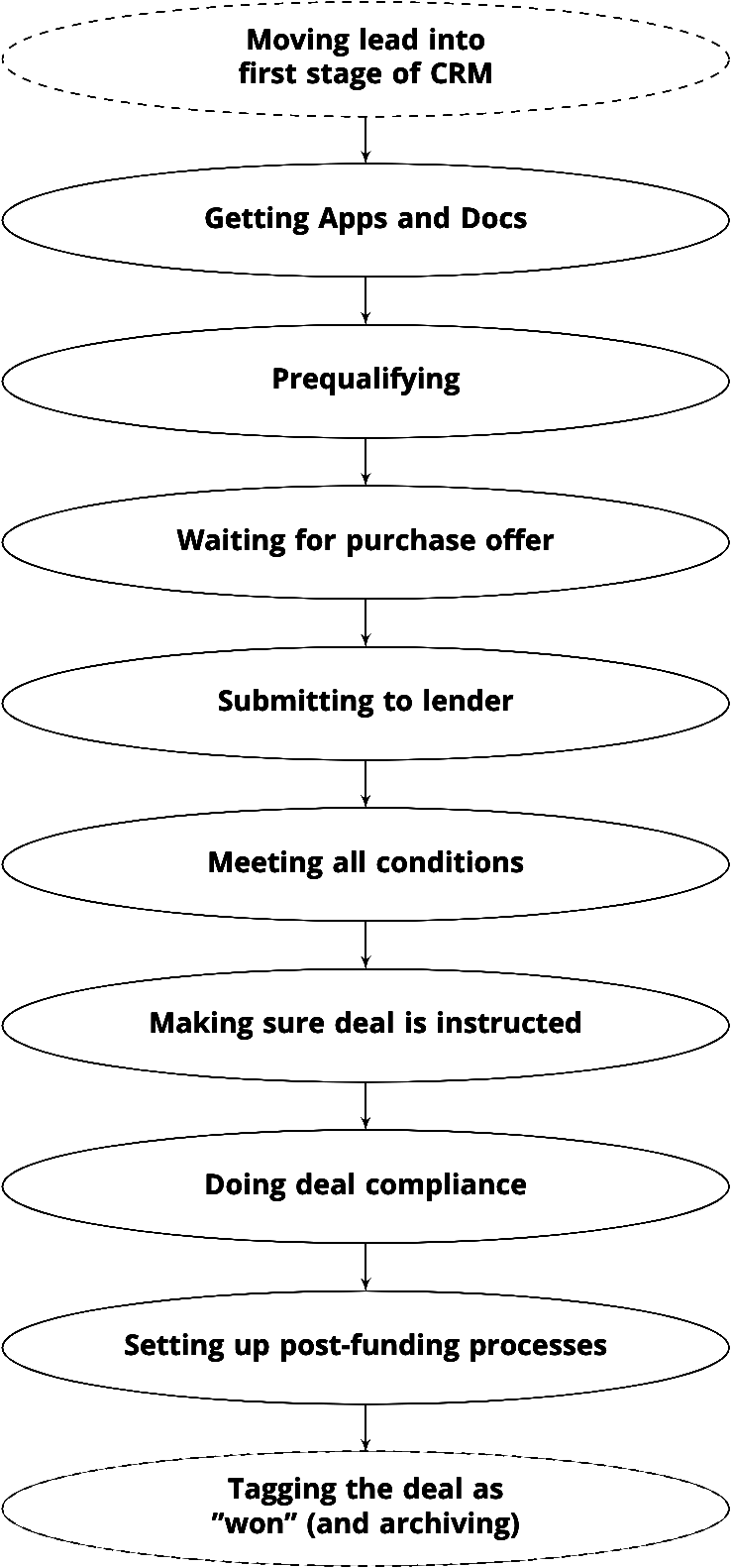

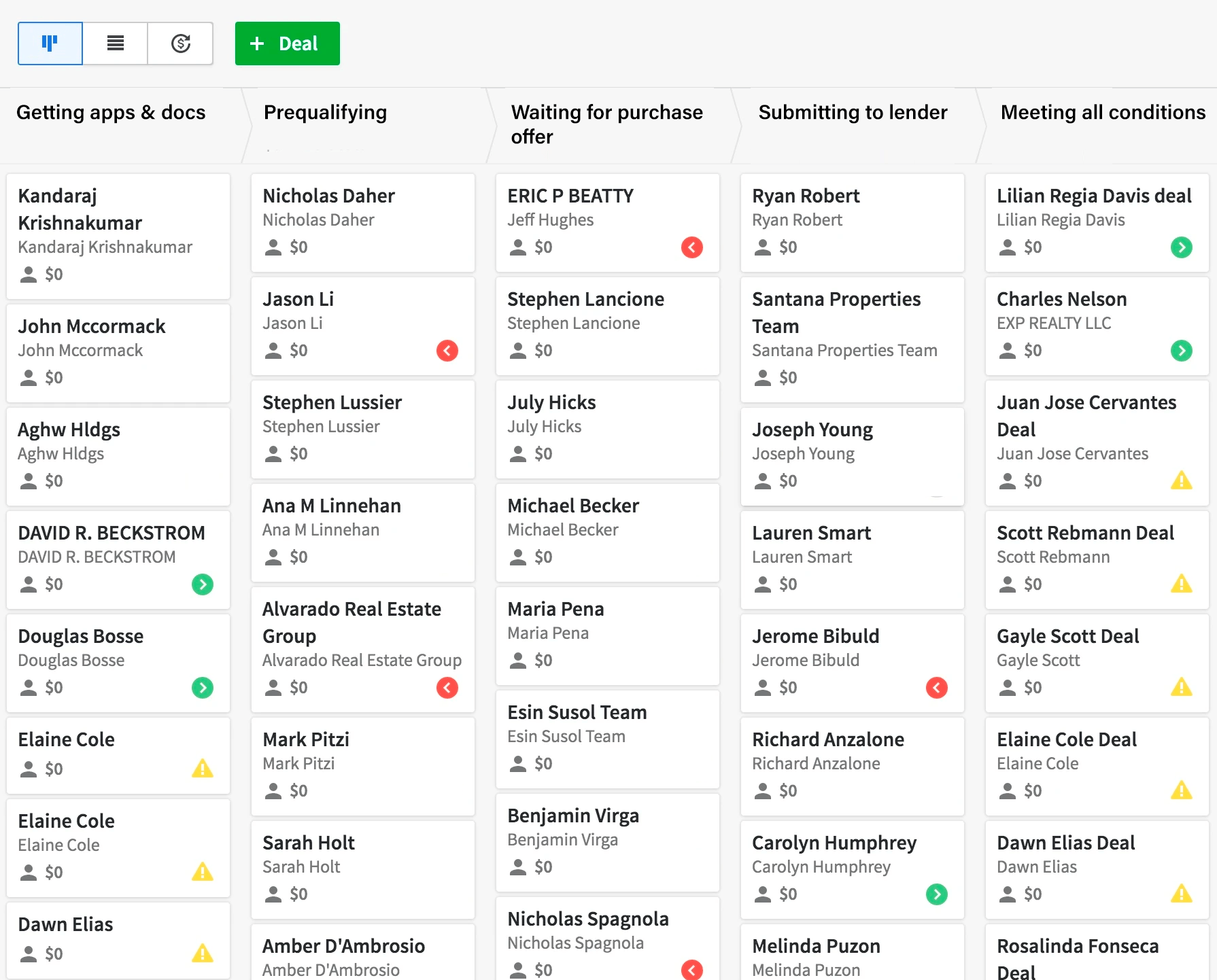

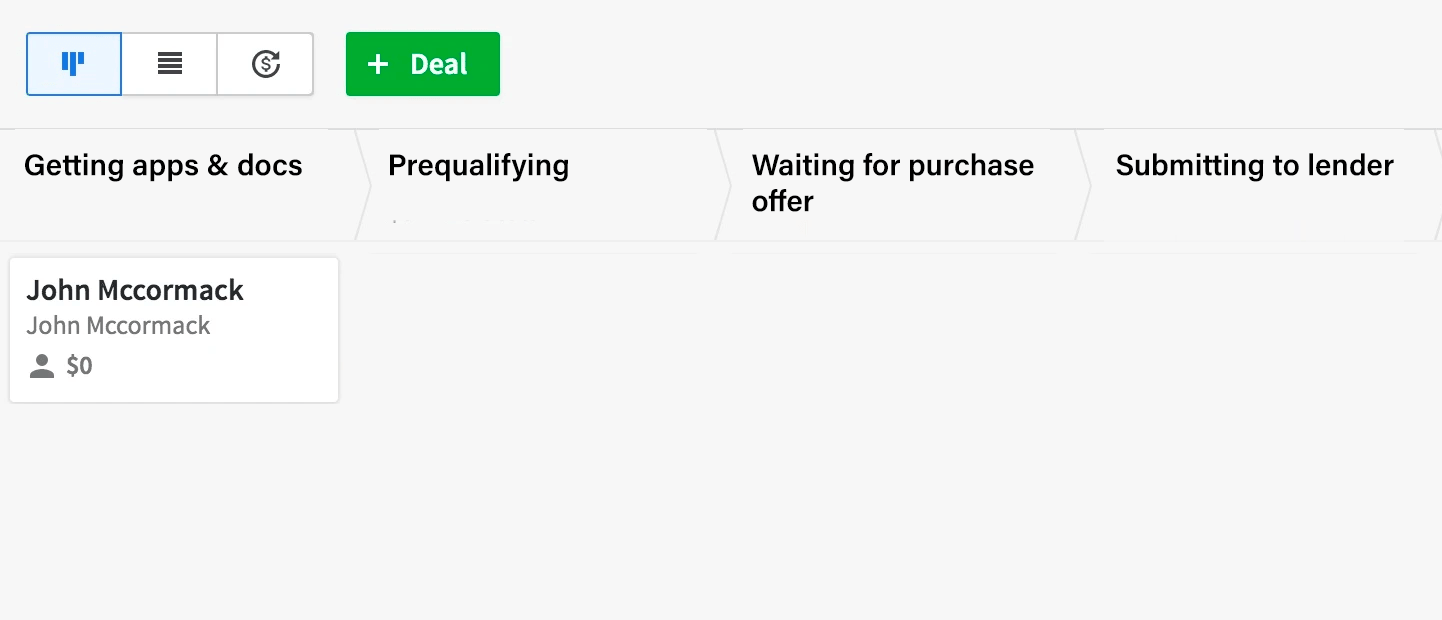

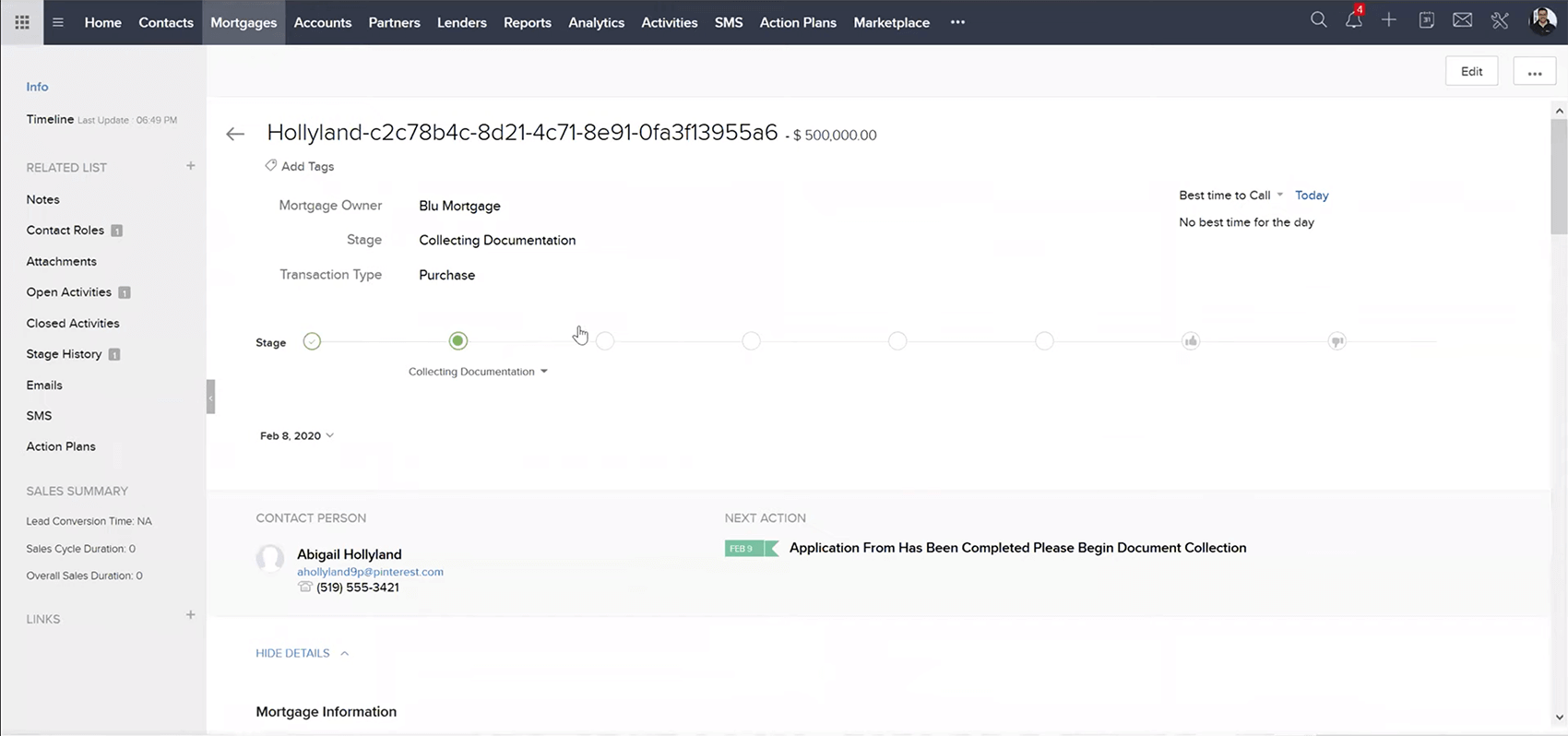

CRM stages

Efficient mortgage professionals use CRMs to increase deal throughput. A well-organized CRM can be the difference between a single mortgage professional having the capacity to complete 3 deals a month, and the capacity to complete 10 deals a month or more.

Setting up the mortgage process in logical stages greatly increases efficiency. Note how the stages are written in what is known as the “present continuous” tense. This essentially means, the stages are titled with verbs that have “-ing” endings, such as “running”.

This reduces mental load, as the title of the stage tells you the exact goal of the tasks to be performed, without the need for additional mental effort.

The stages in this blog post are example stages, and you may want to change or add stages to fit your unique mortgage workflow.

Move the lead to first stage in your CRM sales pipeline

If possible, your sales pipeline should only contain truly active deals. Check if your CRM provides a way to separate your active deals from your leads, lost deals, and completed deals. This will go a long way to staying organized, and avoiding unnecessary mental effort and distraction.

Getting apps and docs

Finmo makes getting full applications with documents from borrowers as simple as possible. The majority of borrowers are able to go through the entire process without any assistance from a mortgage professional. The result of a low-friction application and document process is a massive increase in your potential throughput as a mortgage professional. When you spend less time working “in” your business, you can spend more time working “on” it, doing high value activities such as acquiring new leads or nurturing important referral relationships.

Finmo’s Smart Documents technology utilizes sophisticated rule-based scenarios to automatically request the correct documentation for every mortgage deal. Documents are requested immediately upon borrower submission, for a smooth seamless process. Requesting documents immediately upon application submission greatly increases the likelihood a borrower will upload their documentation, as the documents are requested at the height of the borrowers interest. Additionally, borrowers often need to retrieve a lot of their documentation to fill out the application portion, so requesting documents immediately results in a much lower-friction process. Many of the documents they need to upload are already in their hands.

The occasional borrower may require assistance in fulfilling the mortgage and documentation upload process, and we advise everyone on the Finmo system to occasionally invite themselves as a borrower to test deals to ensure they are familiar with the application process the borrower’s are experiencing. This allows for quick and easy troubleshooting should the need ever arise. It also allows you to test and ensure that your logo, information, custom document requests, etc, are appearing and working as expected in the borrower portal.

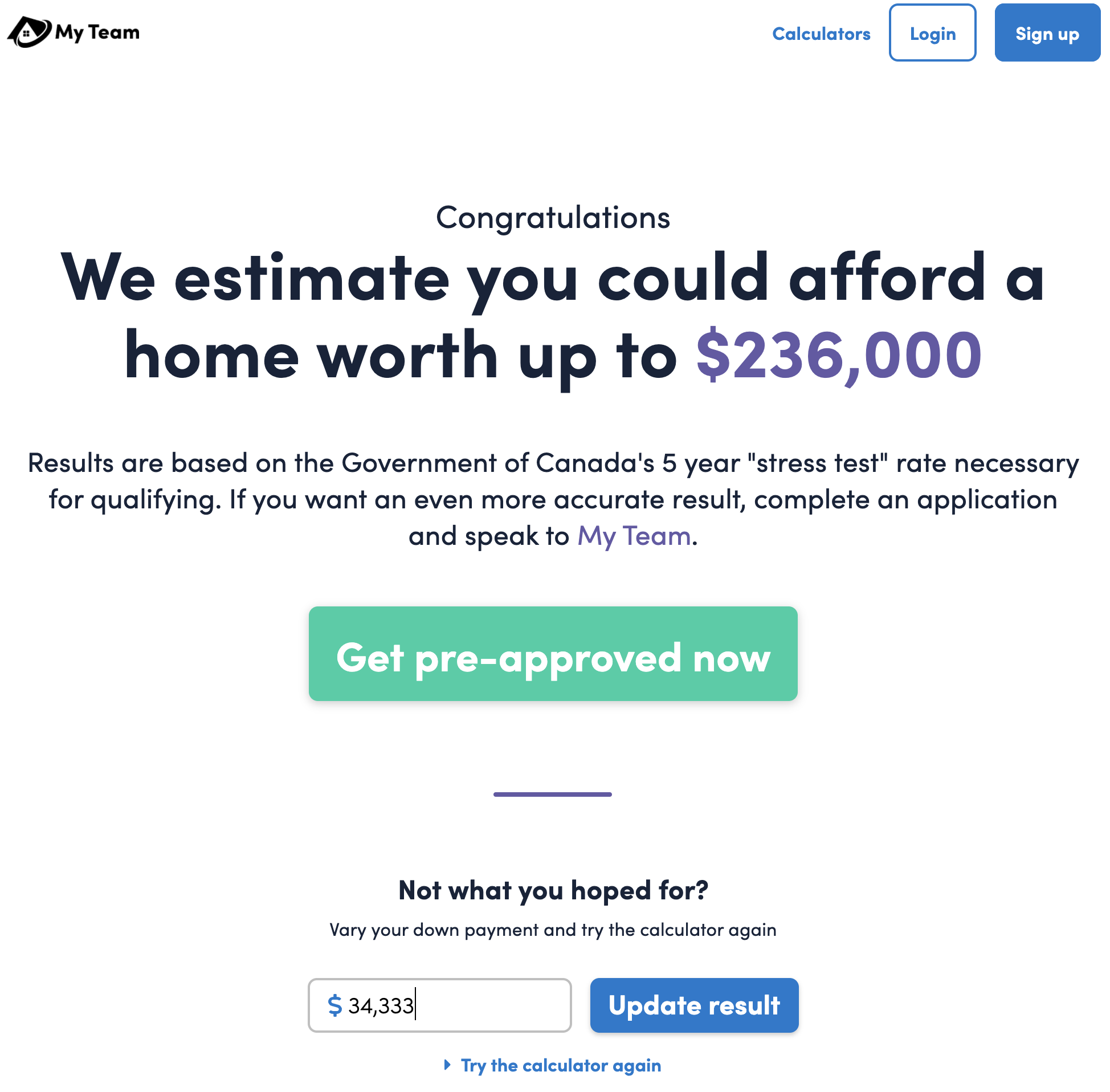

Prequalifying

Prequalifying leads is straight forward in Finmo. Finmo’s GDS/TDS calculators and adjustable settings result in straight forward prequalifications for any scenario.

As part of Finmo’s commitment to streamlining every aspect of the mortgage process, we will soon be releasing a semi-automated prequalification feature. This feature will provide a complete one-button solution to borrower prequalification.

If you need a quick pre-qualification estimate for a borrower, a great utility is Finmo’s lead generation calculator. You can demonstrate it with the borrower present so they understand the value of the lead generation calculator as a resource, or use it yourself to get an accurate pre-qualification estimate without performing complex calculations that are prone to human error. Over the phone you can simply ask the questions presented by the calculator and provide a pre-qualification estimate in seconds. This method works well for both purchases and refinances.

Waiting for purchase offer

Deals reside in this stage while the borrower is shopping for a property to purchase. Some mortgage deals will skip this stage entirely. Deals are moved out of this stage once a purchase offer has been accepted.

Finmo’s Smart Documents functionality automatically requests the signed purchase offer from the borrower (if applicable to the deal). When the borrower uploads the purchase offer, Finmo will notify you to review it. Once you approve their purchase offer, you can move the borrower to the next stage.

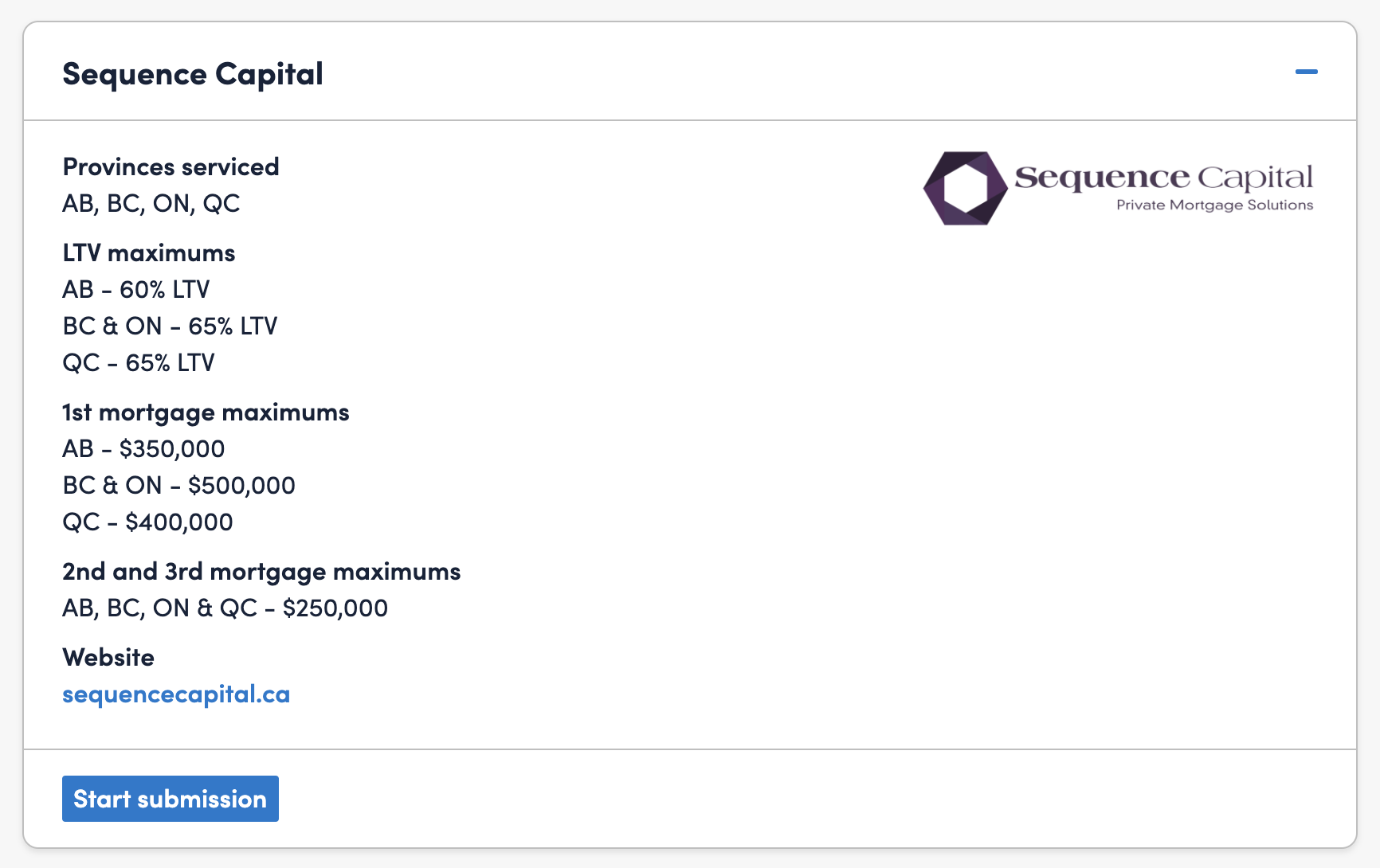

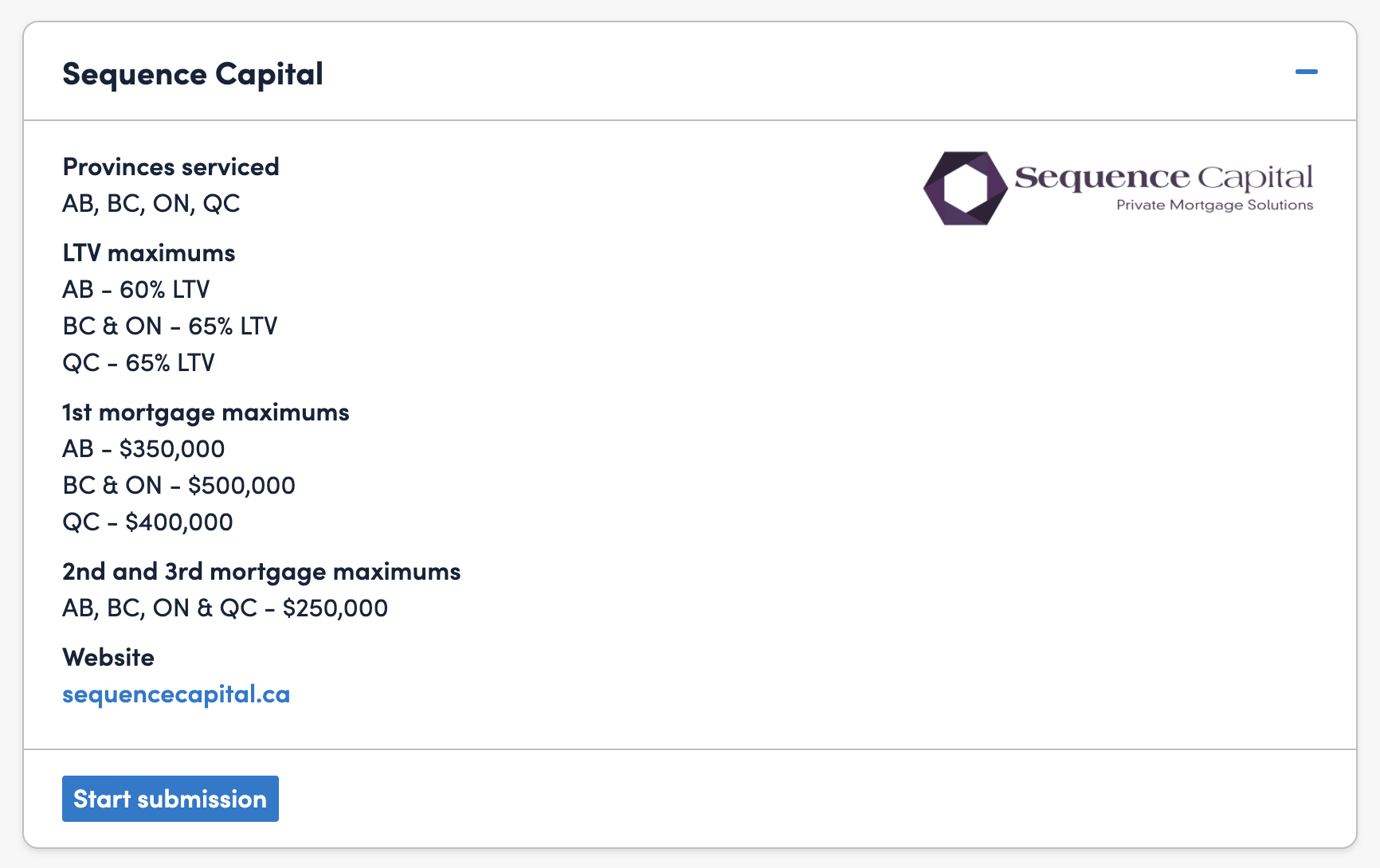

Submitting to lender

This stage is used for collecting all relevant property related paperwork from any Realtors or other professionals that is needed to submit the deal. This stage is also used for the actual lender submission. Deals can stay in this category until an approval from the lender is received.

If desirable, depending on how you detailed you like your sales process to be, this stage could be broken up into three separate “smaller” stages:

- Collecting property related documents

- Submitting to lender

- Waiting for lender approval

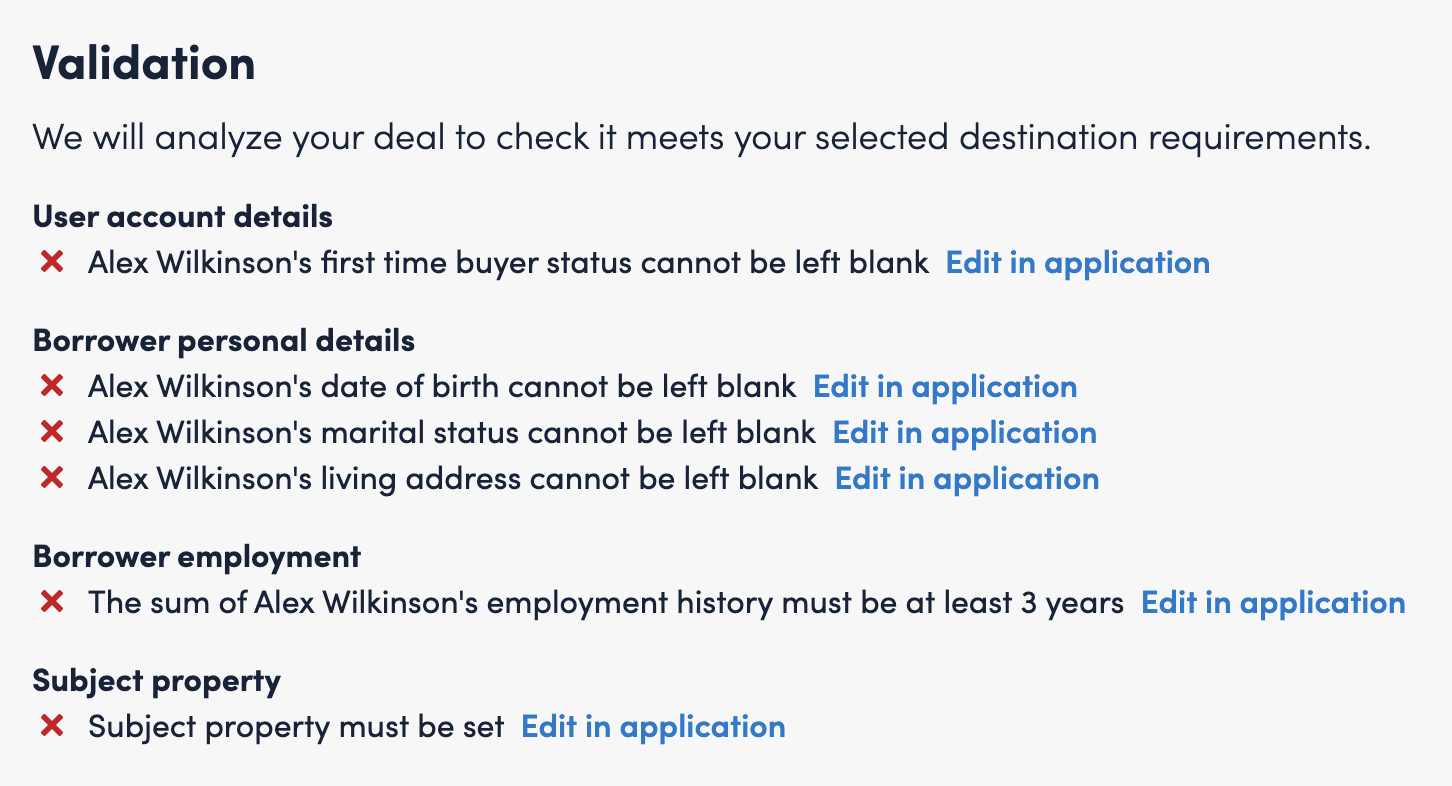

Finmo offers a simpler way to interact with lenders that previous generation software. Finmo features direct submission capabilities as well as a highly advanced deal validation feature that ensures the deal meets the selected lender’s criteria. This prevents mortgage professionals from accidentally submitting deals that do not match a lender’s criteria, reducing human error.

Additionally Finmo provides each lender with their own portal which allows them to approve deals, upload commitment documents, and more. This streamlines communication between the mortgage professional and the lender, which increases efficiency. You are notified inside Finmo when a lender takes a significant action regarding your submission (approving it, declining it, etc).

Once the borrower has an approval and commitment from a lender, the deal should move to the next stage.

Meeting all conditions

Deals remain in this stage until all lender conditions are satisfied.

In the future Finmo will import lender conditions directly, and complete them automatically as the lender approves documentation.

Additionally, as conditions are fulfilled, relevant information will be sent to Realtor’s, lawyers, appraisers, and other mortgage professionals.

Once all the lender conditions are satisfied, the deal moves into the next stage.

Making sure deal is instructed

The purpose of this stage is to make sure the mortgage deal has been instructed. It’s also a good time to verify that everything is in order between your borrower and their chosen real-estate lawyer.

The ability to automatically generate and send solicitor letters will be added to Finmo in the near future.

Doing deal compliance

Perform your regular compliance procedures after a deal is ACM (All Conditions Met) and instructed. This way compliance is already done before the deal closes, which can reduce friction in brokerage payroll functionality.

Finmo is working on the technology to automatically ensure deals are compliant (to your specifications), without any human intervention. This entire step will soon become unnecessary.

Setting up post-funding processes

It is generally safe to set up post-funding processes before a mortgage deal closes, after the financing condition has been waived and the deal has been instructed. Your post-funding processes could include things like putting the client on a marketing drip campaign or sending gifts (to the client and the referral source).

Waiting for close

Deals in this stage are simply waiting for the closing date to pass.

This is the last stage of the sales process, so once the closing date has passed and the deal is complete, the deal has been “won”.

Tagging the deal as “won” and archiving

Once the deal has successfully closed it needs to be marked as “won” and removed from the sales pipeline. If any stage of the sales process could not be completed, the deal should be tagged as “lost” and removed from the sales pipeline.

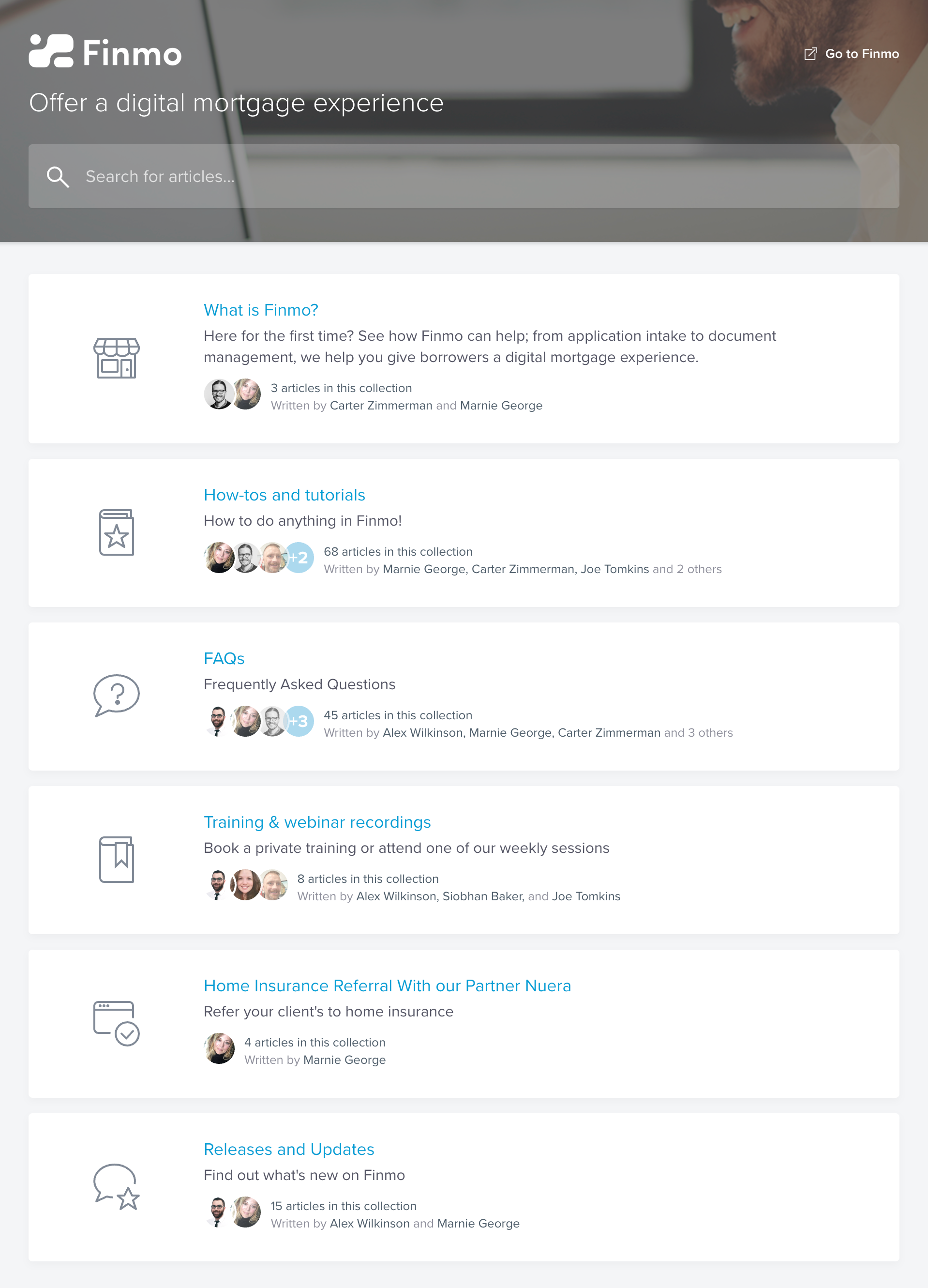

Finmo training

Daily webinar courses

Finmo offers free daily training webinars for all mortgage professionals.

We believe that the fastest way to become a Finmo power user is through our live training webinars. In addition to our convenient daily training webinars, we also offer an extended, complete 1.5 hour training webinar every Monday.

If you’re brand new to Finmo, you may prefer an overview of the platform. If you’re already a Finmo user, feel free to register for as much free training as you would like.

Help centre

Finmo maintains an ever-expanding online help centre. The help centre has more than 150 articles, and is a great resource for learning or troubleshooting anything in Finmo.

Help chat

During business hours, our Customer Success team is available to help at a moment’s notice. You can click the chat bubble in the lower right corner of your screen (when you’re in Finmo or on the website) to talk to us at any time during business hours. At Finmo, we understand that time is money – particularly for mortgage professionals. That’s why we, as a company, prioritize support and training. Our average response time for help chat support is less than 50 seconds.

Cost savings

Subscriptions that are made redundant with Finmo

With a Finmo Pro subscription, you no longer require subscriptions for:

- E-signing:

- Docusign

- Onespan

- Etc.

- Document collection:

- Floify

- FileInvite

- Etc.

- Document storage:

- DropBox

- Google Drive

- Etc.

View Finmo’s pricing page for current Finmo Pro subscription prices.

Integrations

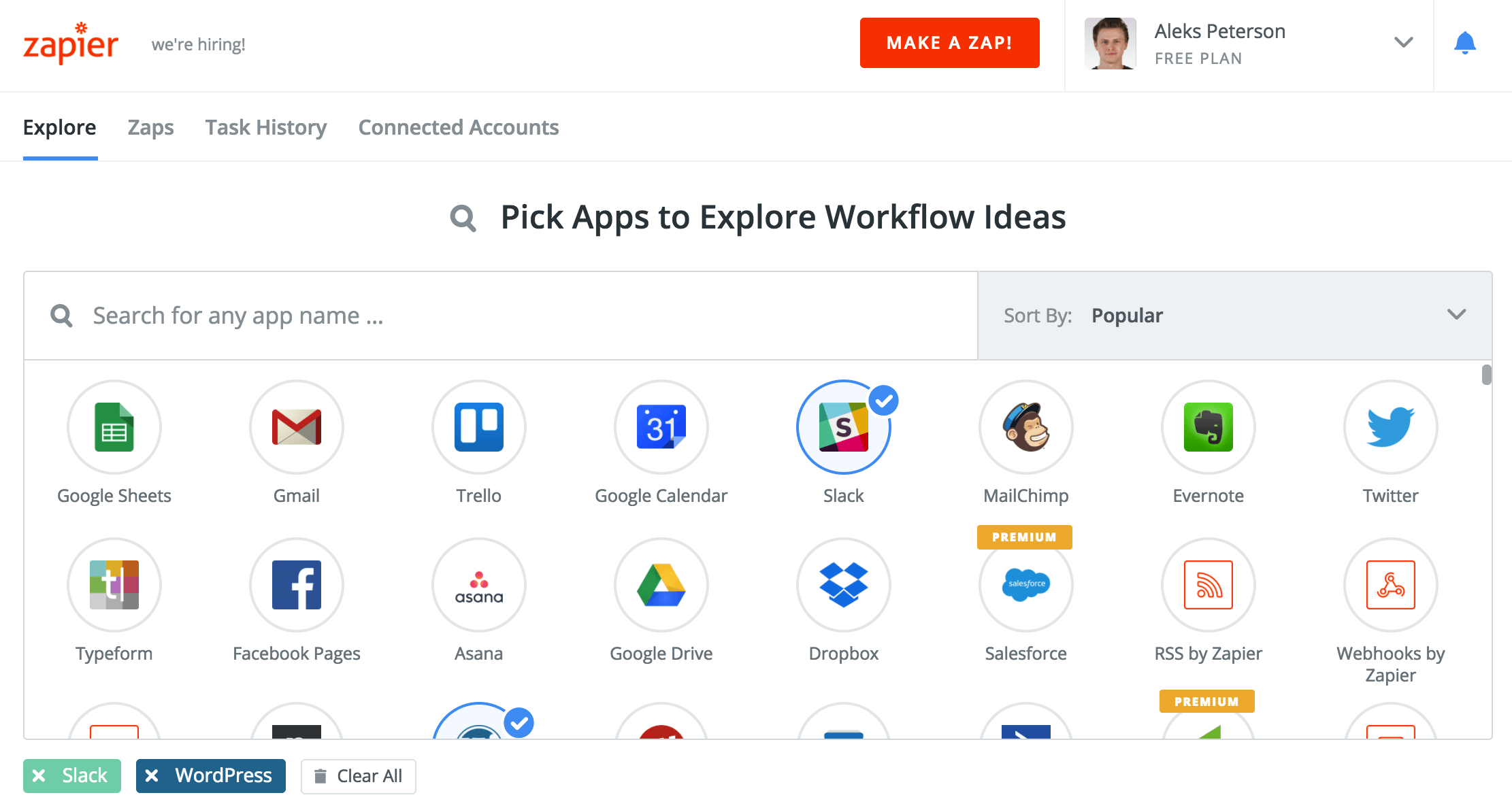

Zapier

Finmo can connect to thousands of popular applications via Zapier. Zapier acts as an online “hub” that connects softwares together, so they can talk to eachother. Through Zapier’s webiste, you can create “zaps”. Zaps are essentially automated tasks that follow an IFTTT (If This happens, Then That happens) structure. So for example, you could make a “zap” for when a new application is submitted to Finmo, a matching new deal is created in your CRM.

This connectivity allows Finmo to remain simple and uncluttered, which is a big part of why it’s so easy to learn, and so powerful. Finmo focuses on and excels at mortgage origination tasks, and leaves other tasks to be performed by world-class software from other companies. For example, Salesforce, Zoho and Pipedrive are all popular CRM (Customer Relationship Management) softwares. They each have budgets in the millions of dollars and entire teams coming up with amazing new ideas on the future of CRM technology. Instead of building a lackluster CRM into Finmo, we allow for connectivity to these excellent third party systems.

We have a library of pre-built and popular zaps you can access and use by clicking a few buttons and connecting a few accounts. This allows you to completely automate repetitive business processes.

If this all sounds a bit too technical for your taste and you just want things set-up for you, no problem. We have turn-key solutions for your CRM and automation needs .

Intercom

Intercom is a popular online chat support platform. It allows users on websites to chat (via written messages) with, and get support from, a real person – right when they need it.

Finmo’s Intercom integration puts the Intercom chat bubble on your team’s lead generation calculators and borrower portal (which is where your leads fill out their application and upload documentation). This means that your leads can click on the chat bubble to chat with you, or your support team, at any point of the process. It provides an additional channel for assistance that is much lower “friction” than an email or phone call.

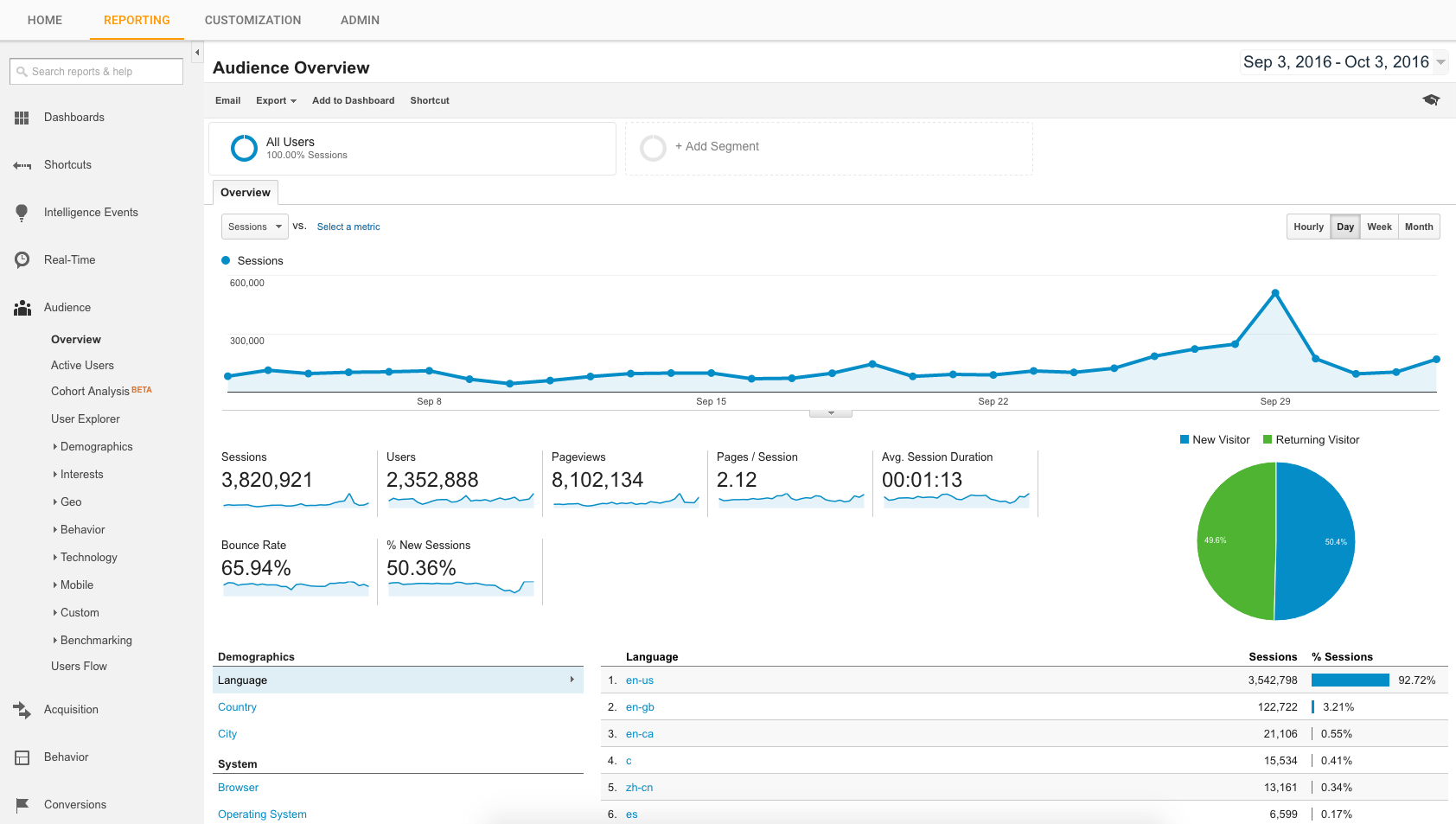

Google Analytics

Finmo’s Google Analytics integration allows Google to see how people are interacting with your mortgage application (in the form of “events”), and even set conversion goals (IE submitting an application) to increase the effectiveness of your online advertising. Google Analytics gives you feedback on the results of your marketing efforts, including deep insight as to what demographics are most likely to “convert” into a closed deal. If you hire a marketing company to do your marketing work for you, be sure to tell them about this integration.

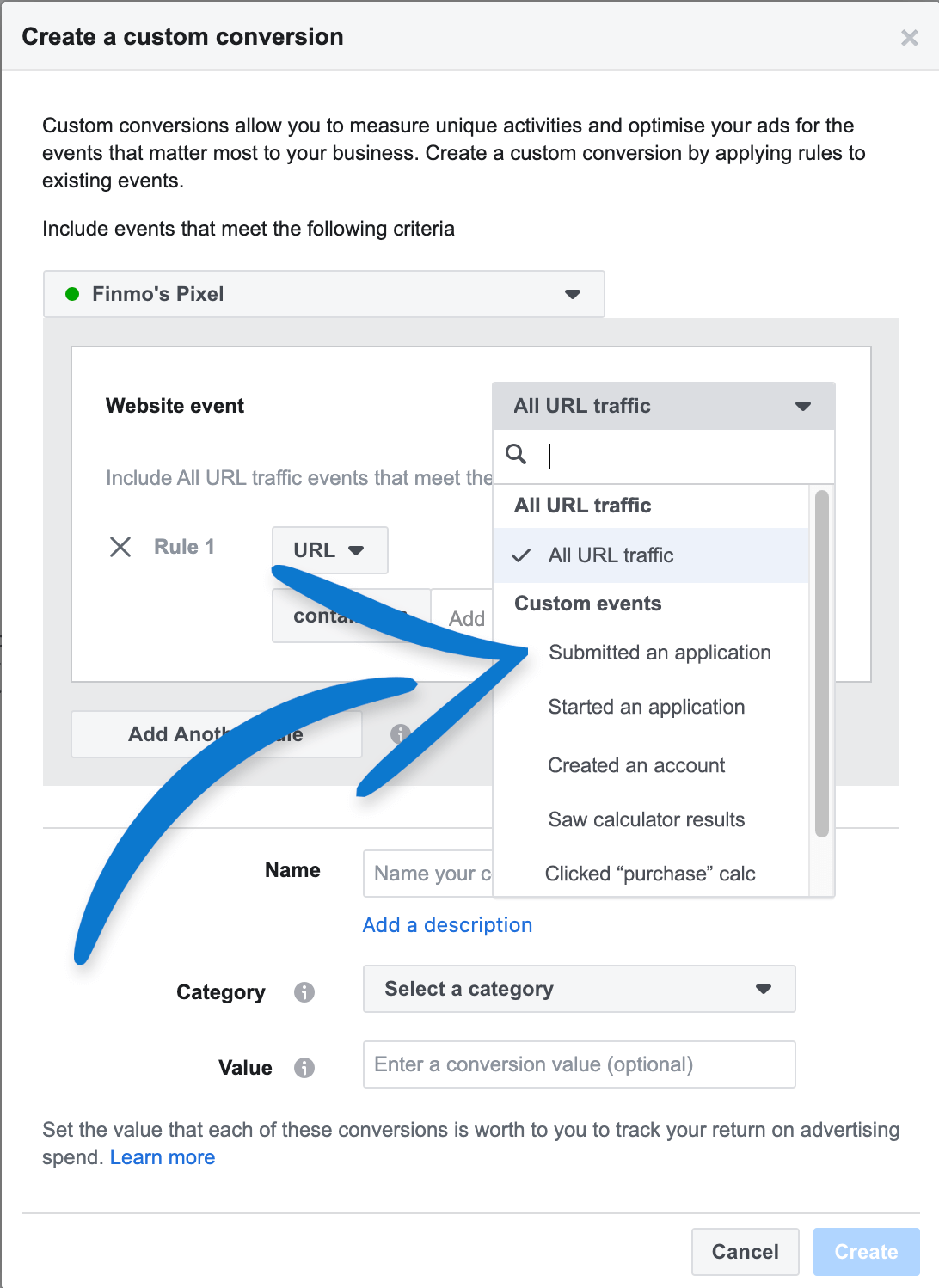

Facebook Pixel

Finmo’s Facebook Pixel integration allows Facebook to see how people are interacting with your mortgage application (in the form of “events”), and even set conversion goals (IE submitting an application) to increase the effectiveness of your online advertising. These events can be used to help Facebook optimize the people it’s showing your ads to, so it can find the people that are the most likely to “convert” into a closed deal. If you hire a marketing company to do your marketing work for you, be sure to tell them about this integration.

Tips and optimizations

Done-for-you solutions

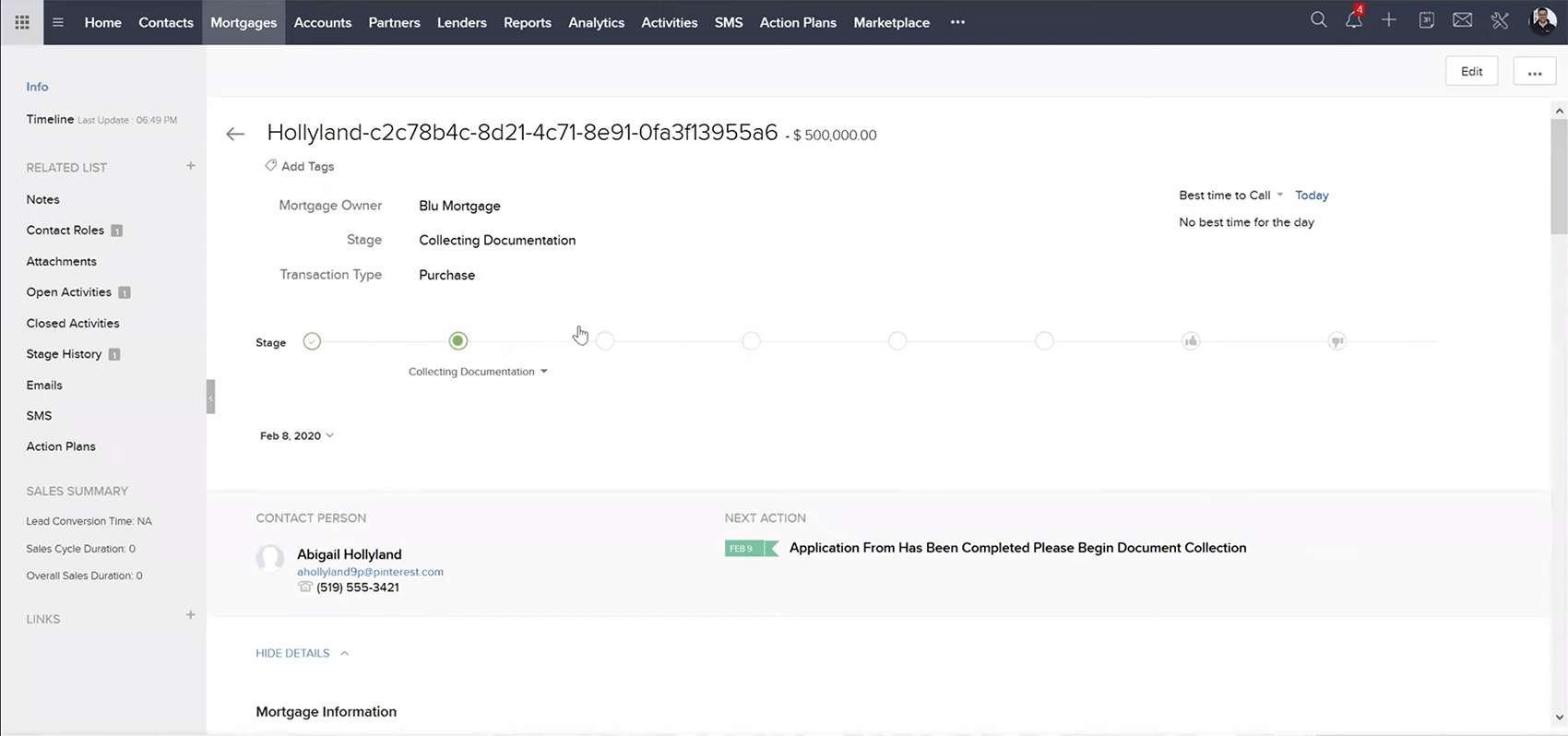

BluMortgage CRM

BluMortgage CRM is a version of the Zoho CRM that has been pre-customized for mortgage professionals. It is a turn-key solution that requires virtually no set-up, and connects to your Finmo account.

Nova Agency

Nova Agency specializes in providing marketing and media services for mortgage professionals and businesses in the Canadian mortgage industry. They have done work for many top mortgage professionals across Canada.

Nova Agency offers the following services:

- Website Development

- Branding & Design

- Marketing Automation

- Data Reporting

- CRM & Integrations

- Content Marketing

- Social Media Marketing

- Search Engine Marketing

- Sales Operations

Single source of truth

A “single source of truth” is preferable in any process or system. It means that there is only a singly copy of every piece of data available, and in a singular location (not including backups for safety). Finmo provides a single source of truth, which reduces the need for redundant systems that can create opportunities for human error. For example, all uploaded documents can be kept directly in Finmo (which has it’s own backups and redundancies), reducing the need for creating a second copy of them on Google Drive or Dropbox, which can then become desynchronized. Desynchronized meaning that two discrete pieces of data exist on two different systems that have accidentally become dissimilar. This could happen for example, when a client emails an updated piece of documentation that is uploaded to Finmo, but not Dropbox, or vice versa. The end result is human error. The chance of error is greatly reduced by using a system that acts as a single source of truth. In the future Finmo will also provide a single source of truth for compliance and other functionality.

Outsource your team’s training to Finmo

One of the biggest advantages of the Finmo ecosystem is the high-quality free training. Since our training is free, unlimited, and available every weekday, you no longer need to spend your own time getting new staff up to speed. Instead, they can simply enroll in Finmo’s webinar training, and within a week they’re ready to go. That means you have more time to focus on higher value tasks, such as acquiring new leads or attending to important referral relationships. Staff can also take refresher courses at any time to make sure they are using Finmo in the optimal manner, increasing company efficiency.

Try Finmo

Thank you for reading our manual on the optimal mortgage professional workflow. If you believe Finmo would be a good fit for you, feel free to sign up or schedule a demo with us.