.png)

Tips from lenders: getting your BFS files approved

Did your client’s side hustle turn into a business? BFS - which stands for Business for Self - is the lingo used to identify self-employed customers for mortgage lenders. Check out what lenders have to say about working on BFS files.

According to a Global News article published on March 25, the most recent Labour Force Survey (LFS) showed that some 2.6 million people were self-employed as of February 2022. That’s a big number, and some of these self-employed people could be your clients.

Recognizing that, we want to help you get your files easily approved through the biggest lenders on the market, so we’ve asked some lenders to give tips on how to best work on BFS files in order to get them approved quickly.

To no one's surprise, documentation, notes, and explanations are essential to have ready for your file to be approved immediately. Aside from that, here are some tips directly from the lenders:

Jennifer Joynt-Johal, Vice President and Credit Operations of Strive, says the notes are key: “Very detailed notes that outline BFS tenure, type of business, any web links, gross and net income (if stated). If there are any concerns on the file (i.e. weaker credit), details like strong retained earnings can help get an approval,” she explains.

Besides all the detailed information, the broker must understand the nature of the client's business. Ask your client what they did prior to the business. Do they have an education in their field? If so, ask for all the necessary documentation.

For RFA, it isn't too different: “Ensure the Business for Self template is filled out before applying, so we don’t have to search for business details,” guides Cheryl Buhs, VP of National Sales. She adds that “this template includes mandatory information that we need in order to submit to an insurer, as well as additional details that help us to understand the nature and structure of the business.”

Here’s a list of the basic documentations needed:

- Having at least 2 years' worth of full documentation is a good idea: Corporate Financials, T1 and correspondent NOA to match the income. If your client got affected by COVID-19, ask for 3 years to be safe.

- Pull a Corporation Search before submission to confirm business ownership. “You don’t want to find out halfway through the approval process that the client only owns 50% of the business,” says Cheryl.

- To rationalize what the income is worth, visit the CRA website and find out if the average earnings from your client make sense with the industry income.

- In case your client has stated income, it’s essential to fill that out too.

As for Community Trust, they require proof of ownership of the business, which may include a business license or articles of incorporation. Other than that, the client must complete a self-declared letter with their broker outlining gross income and expenses. Clients also need to provide proof of income, typically six months of business or personal bank statements, to show that the business is healthy and operates consistently.

What to avoid?

- Once the application is approved or pre-approved, make sure nothing has changed. “A full story, including details of previous lender submissions, an explanation regarding past credit issues, details about previous employment and/or education that led the client to their current field, all of these things make a stronger application and are more likely to get an approval,” says the VP of Credit Operations at Strive.

- In case your client doesn’t have enough time in the industry, mainly for the BFS that started after the pandemic, make sure you advise the underwriting department to get the exceptions needed or gather the necessary documentation before the final submission.

- Dig it deep! “You could have five different clients all in the same line of work, but the business is set up differently, so it is important to ask the right questions,” says Brennan Trenouth, the Director of National Sales at Home Trust.

How Finmo Can Help

As a digital mortgage platform that helps you optimize your mortgage experience, Finmo can certainly help you be more effective with BFS files.

Here are examples of how the BFS proprietorship and BFS corporation files may look like when you work them in Finmo.

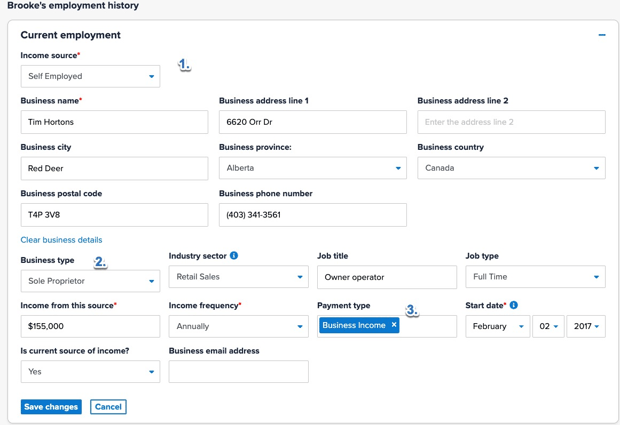

1. BFS (Proprietorship) - The client files as a self-employed individual with the CRA, and you will have to use their T1 Generals and statement of business activities. They always have to include a 2-year average of their income and, due to COVID, might have to include three years. As outlined in the screenshot below, the broker has to determine the income source, business type, and payment type.

(Screenshot: the employment section of Finmo)

Once these three items are chosen in Finmo, our Smart conditions will add the following documents automatically to the client's list of requirements:

- At least two years T1 General income tax returns full (includes the Statement of Business activities)

- At least two years of Notice of Assessments from Revenue Canada

- Confirmation of no income taxes owed to Revenue Canada

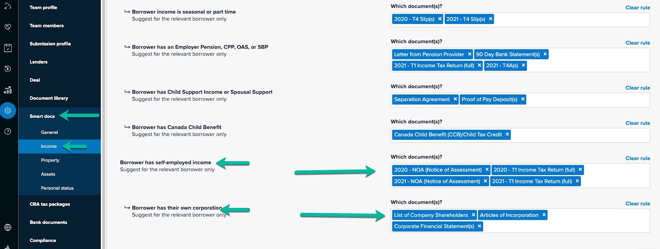

(Screenshot: Smart Document settings section for BFS clients)

When these three items are selected in Finmo, our Smart conditions will add the following documents automatically to the client's list of requirements:

- Two-year T1 General income tax returns full

- Two most recent years NOA's

- Copies of the shareholders' agreement and list of shareholders

- Two years of financial statements from the company

- Confirmation of no taxes owed to Revenue Canada

- Two years of T4's (if applicable)

It’s important to note:

- In case the borrower is buying a rental property in a holding company's name, you can add that holding company as a borrower. As well, every lender will want to see the holding company's documents along with the stakeholders in that company.

- Entering self-employed individuals inside of Finmo as a borrower and as mortgage professionals is the same easy process as entering a regularly employed person.

We hope this information and tips from lenders are useful and help you prepare better before submitting your BFS files!

If you'd like to learn more about Finmo and how it can help you optimize your business, book a 15 minute discovery call and we'll be happy to have a chat!