A New Year, A New Tech Resolution

As we start the 2023 year, most of us have made New Year’s Resolutions, or hope to make small changes that may have a big impact on our lives. We are acutely aware of the time spent doing unnecessary tasks. Or perhaps it is the contrary - maybe we don’t spend any time on the things that actually matter. We constantly question our lives and our habits both consciously and subconsciously. The New Year simply pushes us to reflect further.

As a mortgage broker, you work hard as a self-employed individual. You are increasingly challenged in this new rate environment. Your livelihood depends on being successful, finding qualified leads, and keeping clients engaged and committed throughout the entire process. It’s no easy feat.

To add to this, many mortgage brokers spend an inordinate amount of time managing files, rather than focusing on nurturing the client relationship. By this, I do not mean that administrative tasks replace the relationship. Rather, the relationship becomes encumbered by administrative tasks that are neither pleasant for the client or the broker.

Let’s think about this for a moment. The typical mortgage broker will take a call from a client whose main focus is to make an exciting purchase or to refinance their home for important goals on the horizon. There is a dream of sorts that is whimsically flying in the air, only to get bogged down by the treacherous back and forth emails of requesting supporting documents, manually entering a client’s information into an outdated technology platform, reaching out to overwhelmed BDMs who don’t always get back in time to see if they can help with your deal. You find yourself looking up emails and website information from lenders on their policies and rates, and this too takes time as is not always so clear cut. Clients often forget or delay sending documents, and then it’s often a game of cat and mouse, chasing documents to see if the deal is even viable.

Once you have your clients’ documents, a large percentage of mortgage brokers spend even more time downloading them, converting them to PDF and then renaming them so that underwriters can accept them. This is the life of a typical mortgage broker. It starts with a client’s dream, and often ends up in a quandary of wasted time transacting as opposed to harmoniously moving things along in a pleasant way that makes obtaining financing a reasonable objective.

Adding harmony and balance in our lives is not something that many of us would be opposed to, however, surprisingly, some people fear change that would allow us to live our lives more sustainably. It’s human nature to push back against ideas like technology that would not only save time but allow us to become better versions of ourselves. The question is, why do people fear change? Is it the absence of rationalization, the presence of doubt, or the perception that changing how we live and work will involve more effort?

Make 2023 the year of efficiency

This brings me to ask you, what do you hope to resolve for yourself this year? Does your resolution involve saving you time, increasing efficiency and capturing future business opportunities more easily? Would you like to spend more time with your family? How can this happen, if one does not consider change, which is essentially a positive transformation.

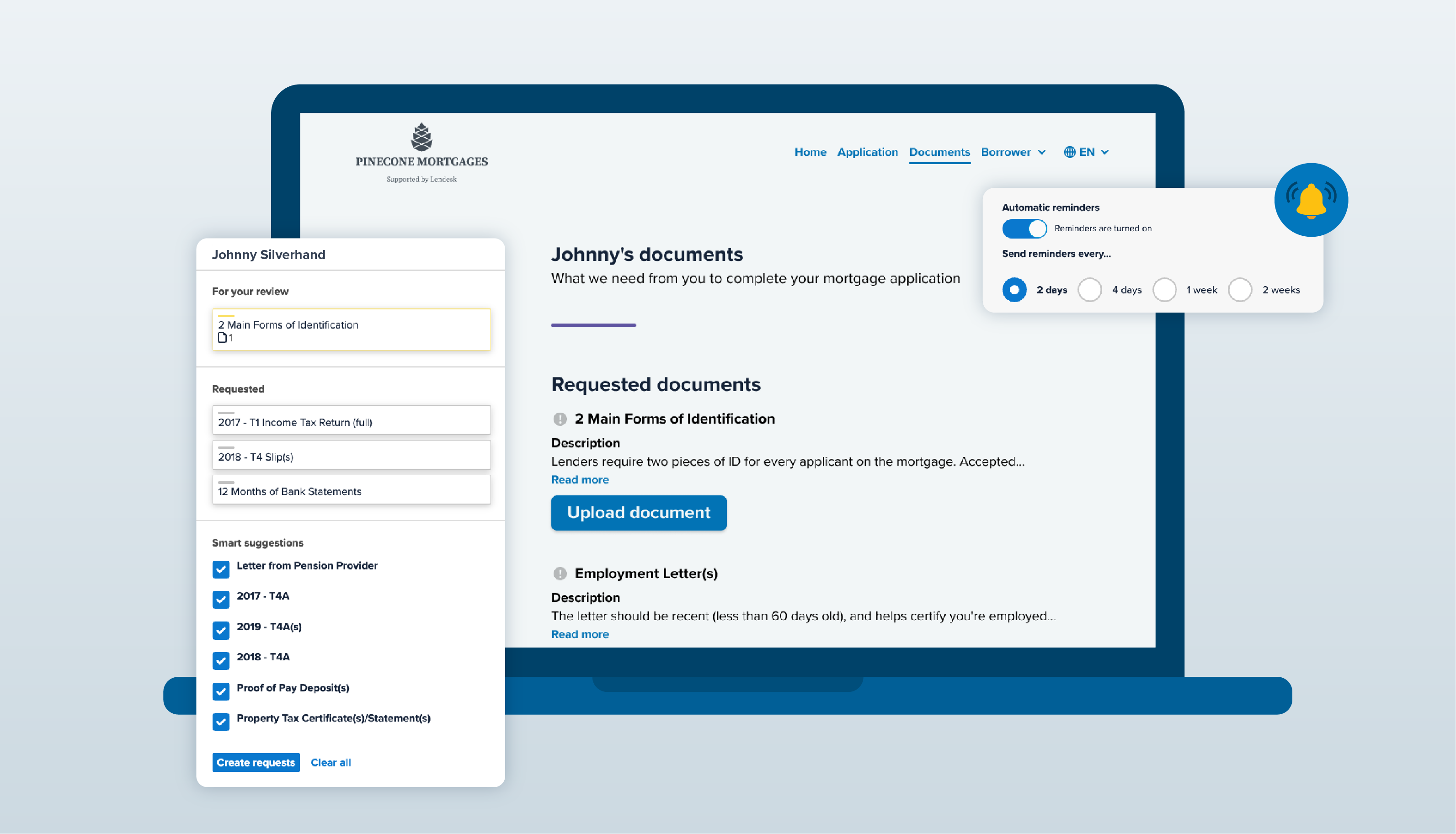

With an origination platform such as Finmo, mortgage brokers solve all the typical broker challenges. Using the best client-facing mortgage application and smart technology to identify which documents clients should submit, shortens the amount of back and forth. This subsequently allows documents to trickle in much faster. There is an additional feature that allows you to turn on automatic reminders for your clients to send in needed documents. Goodbye, document chasing! Better yet, underwriting your deal has now become a breeze due to decreased manual inputs, with the help of the borrower’s application driving the information in your deal. Access to Lender Spotlight means you can drastically reduce your questions to BDMs as policies and rates are right at your fingertips. It will also help identify the most suitable lenders for your deal.

Better yet, underwriting your deal has now become a breeze due to decreased manual inputs, with the help of the borrower’s application driving the information in your deal. Access to Lender Spotlight means you can drastically reduce your questions to BDMs as policies and rates are right at your fingertips. It will also help identify the most suitable lenders for your deal.

In my meetings with mortgage brokers, the platform is often described to me as “slick and intuitive”. There is no steep learning curve that we often see with other mortgage underwriting platforms today. Finmo was designed for any mortgage broker, from the beginners to the high producers and it is used by large shops who fund over a billion dollars yearly. This therefore begs the question: Why choose old tech that wastes time, energy and efficiency when something so simple (and free) is available to use? Make Finmo your New Year’s resolution. It really is that easy.

To learn more about Finmo, start by booking a 15 Minute Discovery Call with our team.