For Canadian home buyers, the national stress test is likely one of the most reviled mortgage policy changes introduced in recent history. While put in place to reduce risky borrowing practices – an acute vulnerability facing indebted households, according to the Bank of Canada – the stiffer mortgage criteria have received the king’s share of criticism for overly cooling some of the nation’s markets.

For this reason, the mortgage and real estate industries waited with baited breath to see if the Guideline B-20 stress test would be eradicated, or at least reduced, in this month’s Federal Budget, in efforts to aid affordability for first-time home buyers.

Other popular proposals included the extension of amortizations for high-ratio borrowers, from the current 25 years to a 30-year timeline. Doing so would reduce the size of monthly mortgage payments, thus making it easier to satisfy the stress test’s income and debt servicing requirements.

A Surprise Approach from the Federal Government

However, neither of these prescribed approaches came to fruition in the Budget announcement. Rather, the federal government has opted to expand the maximum amount first-time buyers can take from their RRSPs via the Home Buyers’ Plan by $10,000 to $35,000, and has introduced a brand-new initiative to split mortgage costs with borrowers.

Called the First Time Home Buyer Initiative, the program will see the Canada Mortgage and Housing Corporation share mortgage equity with first-time buyers by offering interest free loans for a portion of the down payment, 5% for existing homes and 10% for newly-constructed ones. The loan does not need to be paid back until the mortgage matures or the home is sold; to qualify, borrowers must have the minimum 5% down payment saved for an insured mortgage, have a combined household income of $120,000 or less, with the maximum mortgage amount capped at four times those earnings.

Federal Finance Minister Bill Morneau illustrated that on a $400,000 home, getting 10% equity sharing via the FTHBI would reduce monthly payments by $225 per month, or $2,700 per year.

“That’s real help for people who want to own their own home. For young people. For families. For Canadians who need just that little extra help to make their dream of owning a home a reality,” he stated in his speech to the Speaker of the House in the Budget’s unveiling.

However, the FTHBI hasn’t been warmly received by many industry pundits, who say too few details have led to a lack of clarity as to how the program would roll out. The government has said more will be announced when the initiative is implemented this autumn, but it is currently unclear whether the loan would remain a flat amount to be repaid, or whether the equity held by the CMHC would rise and fall with the value of the home and market. There have also been questions raised as to whether this would impact the taxation exemption for principal gains on the home’s sale. As well, with the maximum amount capped below $500,000, many have argued this initiative will do very little to provide relief in markets like the Toronto real estate and Vancouver real estate markets.

What Do Home Buyers Actually Want?

Prior to the Budget’s announcement, Zoocasa ran a national survey on homeowner and renter sentiments, asking which measures they’d most like to see introduced in the budget.

The findings revealed a level of apathy among respondents – while 82% agreed that housing affordability is a major issue facing Canadians, more than half – 55% – felt that the problem can’t be solved by government intervention alone.

And, while intense focus had been placed on the impact of the stress test and extended amortizations, respondents indicated they didn’t have the same concerns. In fact, the largest group – 28% said they’d actually rather receive a larger payout via the First Time Home Buyers’ Tax Credit, which currently provides $750 on up to $5,000 of the home purchase claimed.

Other survey highlights include:

- 82%: The number of respondents who agree housing affordability is a major issue that has negatively impacted Canadians

- 55%: Those who agree housing affordability in Canada cannot be fixed with government policy measures alone

- 21%: Those who feel confident that the government can improve housing affordability in Canada within the next five years. 26% of renters agree, and 19% of homeowners agree

- 57%: Canadians who are aware of the mortgage stress test

- 50%: Of those who are aware of the stress test who feel it reducing housing affordability for Canadians

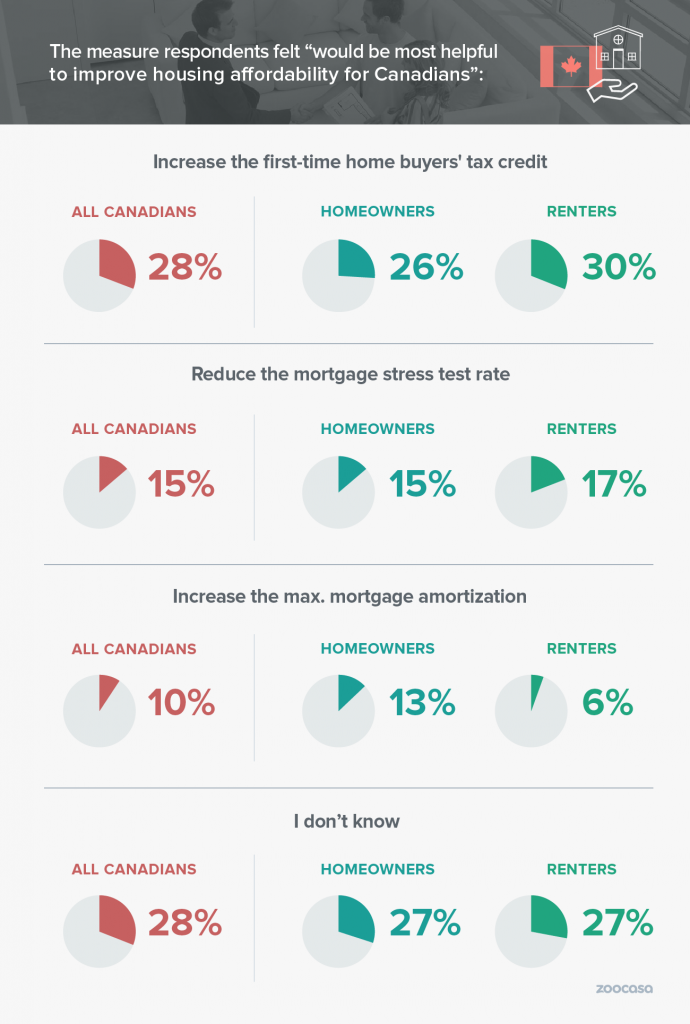

When asked which measure would be the most helpful in improving housing affordability for Canadians:

- 28%: Increasing the First-Time Home Buyers’ Tax Credit amount. 30% of renters and 26% of homeowners agree

- 15%: Reduce the mortgage stress test rate. 17% of renters and 15% of homeowners agree

- 10%: Increase the maximum mortgage amortization period to 30 years. 6% of renters and 13% of homeowners agree

- 8%: Expand the Home Buyers’ Plan. 8% of renters and 8% of homeowners agree

- 28%: I don’t know

- 11%: None of the above