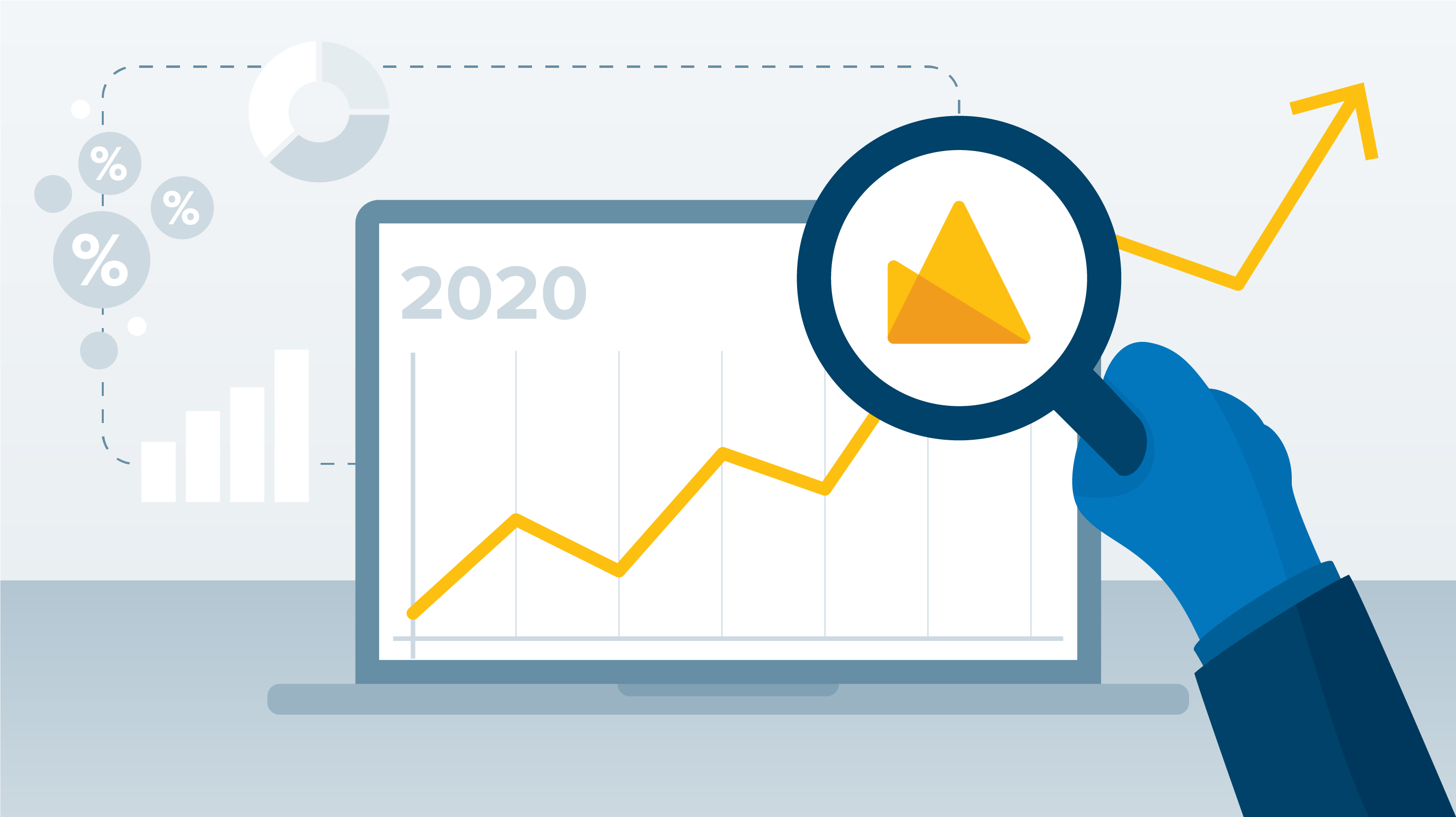

2020: The Year of Constant Change for Brokers

2020 was certainly the year of constant change for Mortgage Brokers – from March 2020 when the government announced mortgage payment deferral options to December when the Bank of Canada stated they would maintain its target for the overnight rate at the effective lower bound of ¼ percent. There was no shortage of industry updates, trends or policy changes to keep up with.

When it comes to lender data and policies, Lender Spotlight is one of the industry’s most powerful and trusted tools. So much so, that it’s updated daily to ensure accuracy. 2020 was a massive year for the Canadian mortgage industry, and nowhere else was this more accurately reflected than with the data changes in Lender Spotlight.

LENDER SPOTLIGHT DATA BY THE NUMBERS

On average in 2020 there were over 6,500 rate combinations at any one time in Lender Spotlight. There were 120,941 changes made this year, a rough average of updating each permutation about 18 times!

If you felt like you just couldn’t keep up with all those rate changes this year now you know why you felt that way. The biggest month overall was April 2020, in the heart of the pandemic where 14,752 rate permutations were updated. This is a record for Spotlight.

Lender Spotlight also hosts close to 6,000 lender policies, with 110 data categories currently tracked across all the lenders and insurers on Spotlight. 2020 has been the year of firsts in so many ways, including some of the questions our support team has been getting. Some of the most interesting questions received included brokers looking for lenders that can help with a file on a wind farm or with an adult lifestyle community or with two cottages on one lot.

Highlighting the above just shows how much data is stored on Lender Spotlight. It can be overwhelming at the best of times, which is why we have a live rate and policy expert on the line in Lender Spotlight during business hours. Lender Spotlight isn’t just for searching and navigating rates and policies yourself, the brokers that get the most out of the product reach out and ask their specific lender or policy questions – we’re here to help.

With so much data at your fingerprints you really are missing out if you aren’t logging on to take advantage of it all. We know there are only 24 hours in a day and with the pandemic still raging striking a work-life balance is still so important. Spending more time than you need trying to sift through your emails looking for just the right lenders means precious time is wasted.

Lender Spotlight Platinum is now available for free, for those that have Finmo Pro. We’d love it if you put Spotlight to use in 2021!