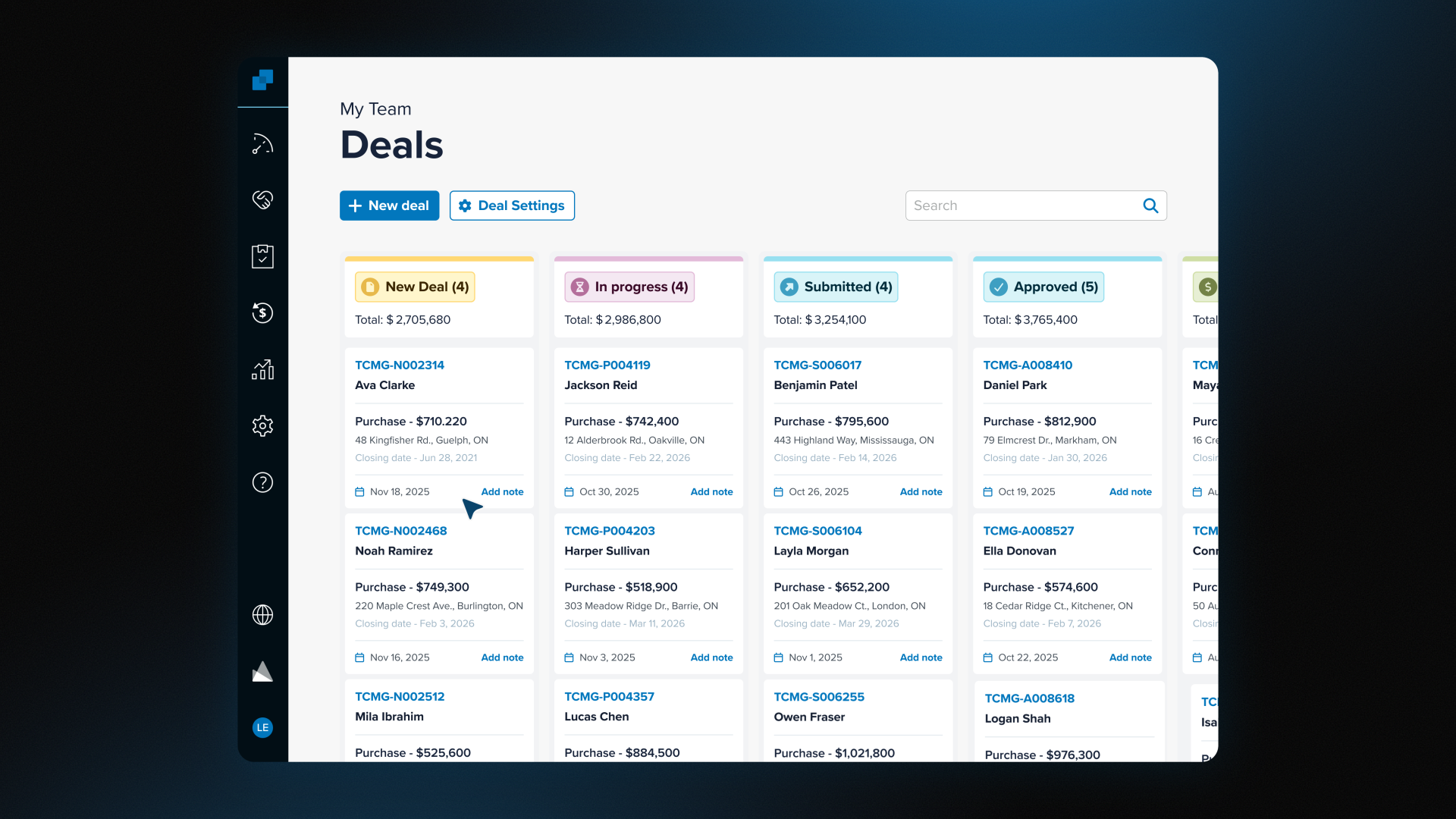

Keeping track of every deal shouldn’t feel like a juggling act. We’re so excited to start the year off strong with card view — a new, more visual way to manage your pipeline in Finmo.

- See your pipeline clearly, at a glance: Card view transforms your deal flow into an intuitive, colour-coded layout so you can instantly understand where every deal stands.

- Move deals forward with less friction: With a simple drag-and-drop workflow and quick-add notes, it’s easy to stay organized and keep your deals progressing.

- Work in the view that works best for you: Easily switch between the new card view or the existing table or list views, choosing the format that fits how you work best.

Getting caught in a compliance audit with incorrect information is stressful and costly.

That’s why Finmo now gives brokerage admins full control over compliance headers—so you can have peace of mind knowing documents are always accurate and consistent.

Here’s what’s new:

- Set compliance headers at the brokerage level, ensuring consistency across the organization

- Create headers by province, with the right license number, brokerage details, address, and logo

- Finmo will apply the correct header based on the subject property’s location

Staying compliant with FINTRAC takes time and attention, and now it’s easier than ever in Finmo.

We’ve added Risk Rating in Finmo—to make compliance easier, more consistent, and built right into your workflow.

What you can do with risk rating:

- Stay organized with compliance requirements tracked directly in Finmo

- Spot high-risk deals quickly and act with confidence

- Cut down on compliance headaches with standardized reporting

We’re excited to share a new, highly-requested enhancement in Finmo that makes running PSA (PEP Screening) checks much more seamless for you and your borrowers.

What’s changed:

Previously, borrowers needed to leave Finmo and go into Persona to enter their details for the screening, which created unnecessary friction. Now with the improved flow, you can initiate and complete the Persona PSA screening directly within Finmo. This means no more action needed from your borrower.

How it works:

- Borrowers provide consent for the PSA screening as an appendix to the general client consent.

- Once consent is received, you can go straight to the Fraud and Risk Assessment section to run the PSA screening with a single click.

- If consent hasn’t been given yet, you can either:

- Enter borrower consent manually to trigger the request, or

- Send a consent email request directly from Finmo for the borrower to complete.

We're excited to announce the release of a highly requested feature: data exports.

You can now export your data from Finmo in just a few clicks—giving you more flexibility and control over how you work. Whether you’re syncing with a CRM, analyzing performance, or preparing for audits, this feature helps you move faster and stay organized.

📋 What you can do with exports

- Keep client records up to date in your CRM

- Analyze pipeline and performance in Excel or Google Sheets

- Share data for audits, reporting, or reconciliation purposes